We Buy Any Home Comprehensive Review (Pros & Cons in 2025)

Updated: April 2025

60 Second Verdict:

We Buy Any Home claims to be the UK’s leading home-buying company, and further states that it assists over 25,000 people a year with the sale of their properties. But are these claims true? Let's delve deeper & find out.

Well-established and regulated (NAPB, TPO, ICO)

Buys any property in any condition — even tenanted or inherited homes

Covers all valuation and closing costs (you only pay for your own solicitor)

Final offer may be lower than the initial estimate often 75%–85% of market value

They do not cover solicitor fees

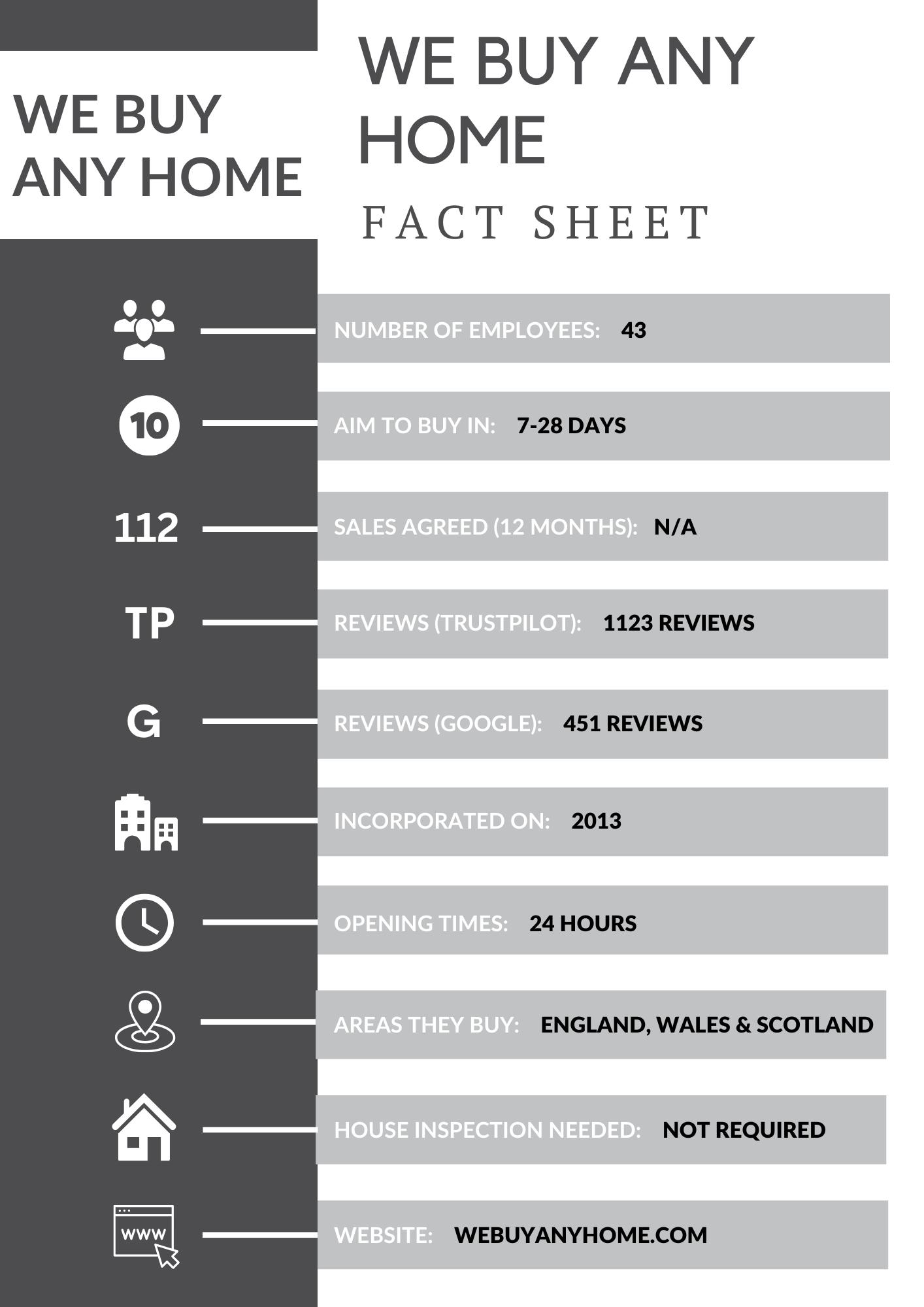

We Buy Any Home Factsheet

| Fact Check | We Buy Any Home |

|---|---|

| Number of employees? | 43 employees |

| What is their aim to buy time frame? | Within 7-28 days |

| How many sales have they agreed? | N/A |

| Number of TrustPilot reviews? | 1123 Trustpilot Reviews |

| Number of Google reviews? | 451 Google reviews |

| When were they incorporated? | 13 May 2013 |

| What are their opening times? | 24 hours |

| Which locations do they buy in? | across UK |

| Is a house inspection needed? | Yes |

| Do they cover legal fees? | No |

| Do they have cash on hand? | Yes |

| What is We Buy Any Homes' website? | We Buy Any Homes website |

*Data updated and correct as of April 2025

What is a We Buy Any House Company

A ‘we buy any house’ company is a cash property buyer that offers homeowners a fast, guaranteed sale by purchasing their property directly, often within 7–14 days.

These companies buy homes in any condition and remove the need for estate agents, chains, or lengthy delays, making them ideal for those needing to sell quickly — though typically at 75–85% of market value.

Who Are We Buy Any Home: Key Details

We Buy Any Home is a London-based property buying company founded in 2013. They operate across England, Wales, and Scotland, offering homeowners a quick and hassle-free alternative to the traditional property market. The company claims to assist over 25,000 sellers each year and can complete purchases in as little as seven days.

Unlike some competitors, We Buy Any Home is a genuine cash buyer, using its own funds to purchase properties without relying on third-party investors. They are regulated by The Property Ombudsman (TPO), a founding member of the National Association of Property Buyers (NAPB), and registered with the Information Commissioner’s Office (ICO).

With a strong focus on transparency, the company offers free, no-obligation valuations and covers all closing costs apart from solicitor fees. Overall, they provide a fast and legitimate option for those needing to sell quickly, particularly in time-sensitive or chain-breaking situations.

We Buy Any Home Reviews

| Trustpilot Reviews | Google Reviews |

|---|---|

| 1123 reviews | 451 reviews |

| 4.3 score | 4.3 score |

*Reviews are updated and correct as of 20/04/2025

Overall, We Buy Any Home is rated 4.3 on Trustpilot and Google.

On Trustpilot, the company currently holds a 4.3-star rating, with 79% of reviews rated five stars.

Alternatively, on Google, the company maintains a 4.3-star rating.

But what exactly are people saying about their experiences with We Buy Any Home?

How is the customer service at We Buy Any Home?

Many of We Buy Any Home’s clients highlight the helpful service and attention they received from the company.

For instance, Stuart Wilson wrote:

Fast and efficient from start to finish. Thank you very much.

- Stuart

Similarly, both Phatcharee Harris and Peter F said they were happy with the experience.

Very helpful. They came back with a response very promptly after submitting the enquiry online.

Spoke to Joel. Very happy. So far so good. Explain everything to me. Very easy process so far. He was very helpful.

- Peter

How fast and easy is We Buy Any Home’s sales process, according to some reviewers?

The speed and ease with which We Buy Any Home proceed and complete the sale is another factor that is commended by several of the firm’s happy clients.

In a Trustpilot review, Paul And Christine Spink stated:

The sale of our late mother’s property, to WBAH, was handled efficiently and professionally by Marcus Horner and Jade Regent. Communication was always timeous and friendly. The process itself was pretty straight forwards, although (due to several unusual circumstances) not as speedy as had been expected. One minor issue related to the Solicitors that were allocated to us (as vendors) by WBAH. Sadly, they turned out to be somewhat less than satisfactory and I would recommend future customers to consider using their own solicitors in order to bypass such a situation.

Others also commented:

I needed a quick sale due to finding a perfect larger property for my family that was available immediately. It’s been a process finding the best avenue to complete quickly but Marcus and Chelsea have been amazing throughout, kept me in the loop daily obviously it’s been pretty stressful on my side but they’ve been brilliant and so kind and understanding to my situation I can’t thank them enough. We’ve taken a bit of a hit financially but they also did all they could to help in other ways, and that is to be expected when needing to complete so quickly. If you’re in a similar situation and needing a speedy sale/ completion I would highly recommend Marcus is straight to the point and honest doesn’t mess around sorting things and the same with Chelsea she’s been so kind whenever we’ve spoken. Other companies I did reach out to when first looking into this route were incredibly pushy and rude often just slating their competitors to get your business not actually caring or understanding to your situation very off putting.

- Carla

However, not everyone has had positive experiences with We Buy Any Homes.

For example, Anne Langley left a 1-star review noting:

What a complete waste of time! Lots of push to get people to review BEFORE the process is concluded. Had I done so I would have left a good review too. Initial contact very promising. Our house was valued at £170,000 by our estate agent and we accepted and offer from WBAH of £140,000. Paid our solicitor to do legal work, all ready to go then suddenly the offer is reduced to £101,000. Luckily we aren't relying on the sale to move as others have been so declined.

Save your time , relist your house as low as you can go and you'll still get more than you will with these sharks.....

- Anne

Susan claims that the company changed their offer last minute.

initially offered us a reasonable sum for my welsh character cottage and at last minute offered a paltry sum that did not even cover all spent on renovations told me this is how they act and all other companies do the same as in offer a good sum then halve it at last minute yes i bought the house and it was in my name till recently when my partner took it over.. we have sold it now for twice the offer price of this firm

- Susan

Lisa claims that the company changed their offer last minute.

Lied to by staff a number of times. Twisted information given by our management company just so they could force us to sell at a third of the price our flat is worth. Money grabbing firm. Avoid at all costs.

- Lisa

Is We Buy Any Home Regulated & Legitimate?

We Buy Any Home has the following attributes:

- Over 10 years in business

- Founding member of the NAPB

- Part of The Property Ombudsman

- Registered with the ICO

Has We Buy Any Home Won Any Awards?

We Buy Any Home does not appear to have won any awards. However, they stated on their website that they were featured in the following:

- Metro

- The Sun

- The Daily Telegraph

- ITV

What Services Does We Buy Any House Offer?

The main services offered by We Buy Any Home are free home valuations, 100% cash purchases, and chain-free sales, including the purchase of tenanted properties:

- Free property valuations: The company offers a no-obligation cash offer, which you will receive within 24 hours of filling out the online form.

- 100% cash buyer only: Using We Buy Any Home’s 100% cash buying service gives sellers the option of a quick sale and money in their account within a matter of days or weeks. This is faster than the months it typically takes to sell a house by auction or through an estate agent.

- Chain-free sales: Because the company is a cash buyer, there are no complicated chains that could cause the deal to fall through. Once an offer is accepted by the homeowner, it's guaranteed to go ahead.

- Sale of tenanted properties: We Buy Any Home offers a guaranteed sale for buy-to-let properties that doesn’t involve having to terminate the current tenancy first.

Do We Buy Any Home Pay Market Value?

No, We Buy Any Home typically offers below full market value. Like many cash-buying companies, they apply a discount to reflect the speed, certainty, and convenience they provide. Their offers are usually in the 75–85% range of what you'd get through an estate agent. While this may be lower, the trade-off is avoiding fees, delays, and broken chains.

Here's some advice from our property expert, Paul:

"Most quick-sale companies, including We Buy Any Home, operate within the 75-85% range of market value.

This discount reflects the speed and convenience offered, as well as potential refurbishment costs. I advise sellers to consider whether the trade-off for speed is worth it based on their financial goals and timeline.”

How Does We Buy Any Home Work?

Selling to We Buy Any Home is quick and straightforward, with most sales completed in just a few steps.

- Get a free valuation – Call 0800 774 0004 or fill out the online Valuation Form to receive a no-obligation property valuation.

- Receive a cash offer – You’ll get an offer within 24 hours of submitting your details.

- Accept the sale – If you're happy, they’ll handle all the legal work and complete the sale for you.

Why Would I Use a ‘We Buy Any House’ Company?

You might choose a ‘we buy any house’ company if you need to sell quickly and with minimal hassle.

These firms offer a straightforward, chain-free sale—often completing in just 7–14 days—and buy properties in any condition, making them ideal for homeowners facing urgent or complex situations.

Common reasons people use these companies:

-

Need to stop repossession or clear debts quickly

-

Struggling to sell through traditional estate agents

-

Inherited a property and want a fast sale

-

Going through divorce or separation

-

Relocating for work or personal reasons

-

Want to avoid viewings, repairs, or lengthy delays

Can You Negotiate With We Buy Any Home?

Like any company that buys properties, it's possible to try and negotiate with them to see if they can offer you a better price.

However, it's important to keep in mind that We Buy Any Home typically offers a fair price based on the market value of your property.

Essentially, they need to pay less than market value for your home, so that they can make a profit on their investment.

The benefit to you as a customer is that they’ll buy your property without asking any questions, and they’ll do it in a quick and convenient manner.

What are the Pros & Cons of Using We Buy Any Home?

While We Buy Any Home offers speed and convenience, there are also some drawbacks worth considering before making a decision.

Pros of using We Buy Any Home:

-

Quick cash offer: Submit your property details and get a no-obligation cash offer within 24 hours.

-

Trusted and transparent: A founding member of the NAPB, part of The Property Ombudsman, and registered with the ICO.

-

Established reputation: Over 10 years in business, offering reassurance in a fast-moving industry.

-

Buys tenanted properties: Will purchase buy-to-let homes with sitting tenants.

-

Fast commercial sales: Can buy commercial properties in as little as seven days.

Cons of using We Buy Any Home:

-

Unclear pricing: Doesn’t disclose how much below market value their offers typically are.

-

Solicitor fees: You’ll need to cover your own legal costs.

-

Poor communication: Some reviews report a drop in communication after signing the contract.

-

Reduced final offers: Customers have reported significant reductions from the initial offer during the process.

We Buy Any Home vs Other Quick Sale Companies

Below, we’ve highlighted some of the key differences, such as average sale time, hidden fees and more, compared to other UK house buyers, such as HouseBuyFast, British Home Buyers, SpringMove, or Smooth Sale.

Quick Sale Firms

- Takes 6-9 months to find a buyer

- Some firms charge hidden fees

- Won't always buy any type of home

- Can take months if not true cash buyers

- Some firms do not offer complete confidentiality

- Not all quick sale firms offer a cash advance service

We Buy Any Home

- Receive a cash offer in 24 hours

- They do not cover legal fees

- Helps sell any home

- Can complete in 30 days or less if opting for cash sale

- Full confidentiality & privacy

- May not offer cash advances

When comparing companies, homeowners should assess additional factors like legal fee coverage, flexibility in negotiations, and transparency in valuations, which can vary significantly between providers.

More advice from our Property Expert Paul:

"When selling with We Buy Any Home or any quick-sale company, I recommend verifying their regulatory status and financial proof upfront. I advise requesting their latest proof of funds statement and checking their current NAPB membership.

This way, you can be sure you're working with a legitimate buyer who can complete the sale within the promised timeframe."

How to Spot We Buy Any House Scams: 5 Key Red Flags

Not all ‘we buy any house’ companies operate fairly. Here are five red flags to watch out for when choosing a cash buying firm:

1. Not registered with TPO or NAPB: Legit companies should be members of The Property Ombudsman (TPO) and the National Association of Property Buyers (NAPB). If they’re not listed, proceed with caution.

2. No proof of funds: A genuine cash buyer should be able to show evidence they have the funds to buy your property, without relying on mortgages or investors.

3. Vague or changing offers: Be wary if the company gives you an unusually high initial offer, only to reduce it significantly just before completion (a tactic known as gazundering).

4. Pressure to use their solicitor: Reputable firms may recommend a solicitor, but they should never force you to use one. You always have the right to choose your own.

5. Poor or fake reviews: Look for verified reviews on independent platforms like Trustpilot. Repeated phrases, no reviewer history, or a flood of recent 5-star reviews can be a red flag.

Always research thoroughly and don’t be rushed—legitimate companies won’t pressure you into a quick decision.

Should You Sell Your House to We Buy Any Home - Our Verdict

We Buy Any Home is a well-established, regulated cash-buying company offering quick, hassle-free property sales across England, Wales, and Scotland.

They can complete purchases in as little as seven days, buy homes in any condition, and handle most of the paperwork—making them a convenient option for sellers needing speed and certainty.

That said, offers typically range between 80–85% of market value, and some customers report last-minute price drops or poor communication. You’ll also need to cover your own solicitor fees, and there may be penalty clauses if you withdraw after agreeing to proceed. Always compare offers and read the terms carefully before committing.

*This article is a comparative analysis review based on publicly available data, customer reviews, and personal research. We are not affiliated with We Buy Any Home or any other house buying company mentioned. The information provided is intended for informational purposes only and should not be taken as financial or professional advice. We encourage readers to do their own research before making any decisions.

We Buy Any Home Factsheet - (Free Download)

You can now access all the key information about We Buy Any Home in the Factsheet infographic we have created below.

Simply click on the image or the link that appears after the factsheet, and it will automatically download it to your device!

| House buying company | Trustpilot score | Google score | Feefo score |

|---|---|---|---|

| Quickmovenow | 4.4 | 4.4 | No reviews |

| Good Move | 4.8 | 4.7 | No reviews |

| Property Solvers | 4.5 | 4.8 | No reviews |

| National Homebuyers | 4.3 | 4.0 | No reviews |

| Open Property Group | 4.6 | 4.0 | 4.9 |

| British Home Buyers | 4.7 | 4.9 | No reviews |

| Ready Steady Sell | 3.7 | No reviews | No reviews |

| We Buy Now | 4.3 | 4.1 | No reviews |

| SpringMove | 4.8 | No reviews | No reviews |

| TheAdvisory | 5.0 | 5.0 | No reviews |

| Ask Susan | 3.2 | No reviews | No reviews |

| Property Cash Buyers | 1.2 | No reviews | No reviews |

| HouseBuyFast | 4.4 | 4.7 | 4.7 |

| Home House Buyers | 4.9 | 5.0 | No reviews |

| Smooth Sale | 4.7 | 4.7 | No reviews |

| Express Offers | 4.0 | No reviews | No reviews |

| Upstix | 4.1 | 3.3 | No reviews |

| Sold | 4.5 | 3.5 | No reviews |

| House Buyer Bureau | 4.5 | 4.6 | No reviews |

| Zoom Property Buyer | 4.6 | 3.0 | No reviews |

| Bettermove | 4.6 | No reviews | No reviews |

| Sell House Fast | 4.7 | No reviews | No reviews |

Browse our comprehensive reviews and expert insights to find the best company for your situation.

*Note: Review data is usually less than 12 months old, please click and read the individual reviews above for up to date details on each website.

Got a question or want to talk to a property sales expert?