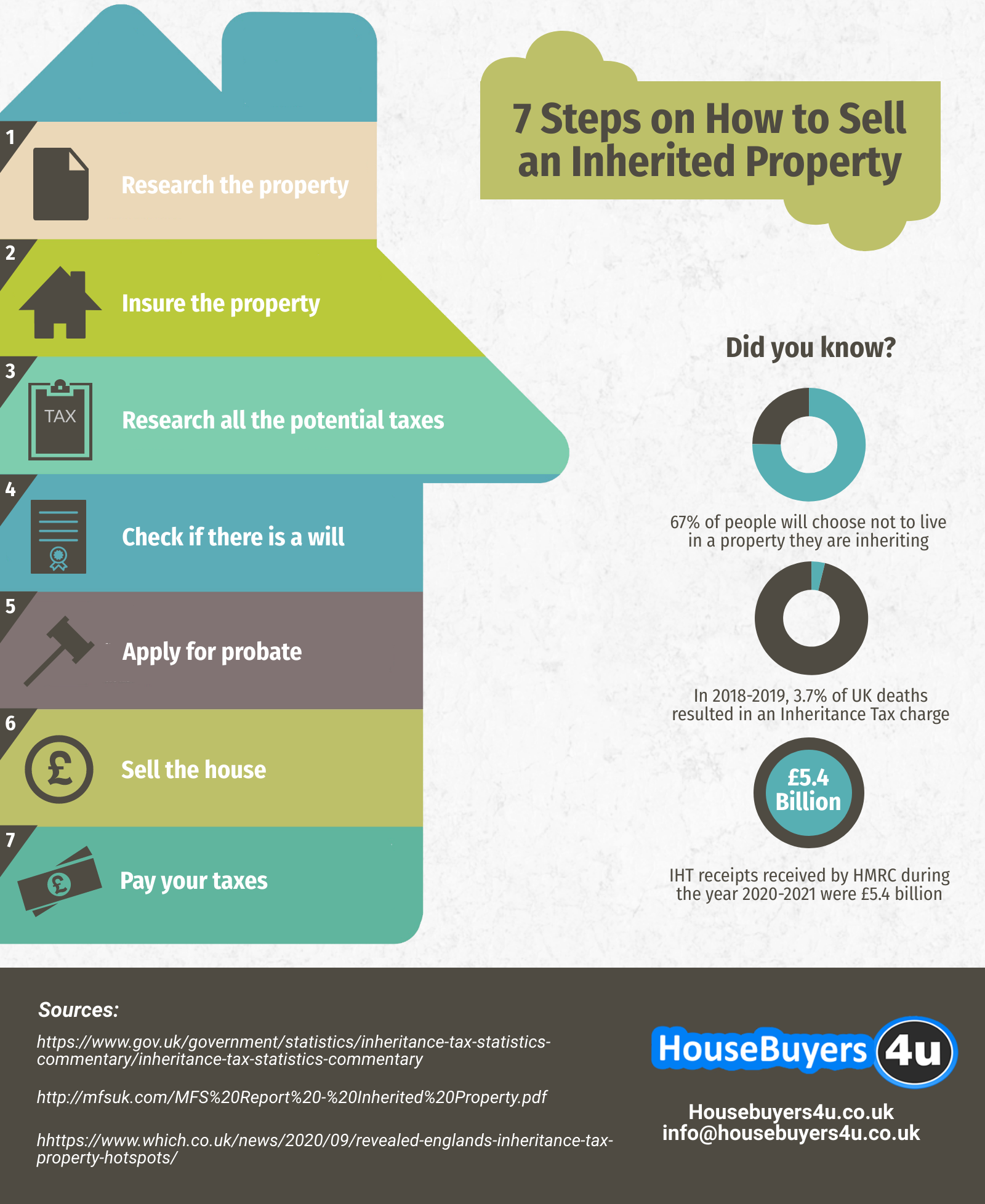

Sell Inherited Property – An Easy 7 Step Guide Plus Taxes

Selling an inherited property can come across as a daunting task for many of us. In addition to dealing with the loss of a family member or close relative, there are many legal concepts one has to be aware of, such as inheritance tax, capital gains tax & more.

To simplify things, we've put together an easy step-by-step guide on how to sell your inherited house in the UK.

How to Sell an Inherited House

1) Research your acquired property

It’s always the first steps that are the hardest to take. When selling an inherited house, the first steps mainly consist of researching what tasks need to be undertaken and obtaining insurance for the inherited premises.

In almost all cases, the inheritance recipients are unsure of what will happen if they sell an inherited property. This is why it is imperative to start with research, so you're prepared for everything.

Usually, when you inherit a house, all the debts have already been paid off. But, unfortunately, that’s not always the case. Sometimes, if the previous owner died unexpectedly, the house might still have some debts.

The best practice in this situation is to try and see if you can pause the payments until you sell the house.

2) Insure your property

Most of the time, an inherited house is also an empty house, and an empty house attracts hazards. As a result, the house can be exposed to several risks; these include natural hazards such as pests or domestic incidents such as fires or floods.

The best practice, in this case, is to insure your house for the time between accepting the inheritance and selling the home. This way, you can conserve the value of the house.

3) Research the potential taxes

A very common question that gets asked when people first inherit property is, "if I sell an inherited property, is it taxable?". The answer is yes, and we'll cover what you need to know below.

One of the most complicated steps when selling your inherited house is determining if and what type of taxes you will have to pay once the sale is completed.

Customary, there are three types of fees/taxes:

- Inheritance tax (IHT)

- Capital gains tax (CGT)

- Income tax

Let's take a closer look at these 3 below.

1) Inheritance tax (IHT): The most organised approach, when it comes to leaving an inheritance, is to try and pay the inheritance tax dues before one’s passing. Few are aware that this is even an option; however, this can significantly ease the process for loved ones.

Inheritance tax is a fee that has to be paid to the government if you are planning to leave a property to somebody else as an inheritance.

Inheritance tax does not have to be paid if you want to leave the property to your spouse or legal partner in the event of your death. Otherwise, the inheritance tax will be calculated as a percentage of the value of the inheritance.

2) Capital gains tax (CGT): Investopedia defines capital gains taxes:“ A type of tax applied to the profits earned on the sale of an asset.

From this, we can safely say that in the case of selling an inherited house, you will only be taxed if you profit from the sale.

How do I avoid capital gains tax on inherited property?

The UK government offers a few details regarding selling an inherited property. They state clearly that you don’t pay capital gains tax if you don’t profit from the sale.

For example, if you receive the inheritance & you already own a house, you have to declare to HMRC (HM Revenue & Customs) which one of the houses is your primary residence. By doing so, if you decide to sell the one that is not your primary residence, you have to pay the capital gain taxes.

If you fail to do so, the HMRC will take it upon themselves to decide which one of them is your primary residence, and, in the end, you will still pay the taxes.

How is capital gains tax calculated on the sale of inherited property?

In its simplest form, you can calculate CGT by getting the sale price of your property and then subtracting the taxable basis. This will determine your gain.

For more information on this, click below: https://www.gov.uk/capital-gains-tax

3) Income tax: This type of tax only applies if you previously used the inherited house that you are currently selling to generate an income (E.g. you have been renting the home.

For more details on how and which of the taxes above are to be applied in your case, check: https://www.gov.uk/tax-property-money-shares-you-inherit/property.

Once your research is done and you're happy you understand the tax systems well, it’s time to move on to the following 4 steps.

The best practice, in this case, would be not only to learn and research the taxes yourself but also to talk to a professional who is familiar with property & all the taxes that apply. There is a chance that the tax due may differ if you're inheriting a house from your parents in the UK, so be sure not to skip this step!

4) Check if there is a will in place

To sell the property, be sure that the house's former owner has not left a will.

If there is a will, confirm that according to the will, you are the property's sole heir so that you can sell it without any problems.

5) Apply for probate - Do I need probate to sell an inherited property?

Whether there is a will or not, you need to apply for probate to sell the house.

A probate is a legal term of a document that gives you the right to “administering of a deceased person's will or the estate of a deceased person without a will.”

You can apply for probate by paying a probate practitioner to do it on your behalf.

6) Sell the house - What are your options

When it comes to selling an inherited house, you have several options. The main 3 are:

- Selling via estate agents

- Selling via the auction house

- Selling via a sell house fast company

Each option has its own benefits. Ultimately comes down to how fast you want to sell the inherited property.

Lastly, before proceeding with the sale, you may want to consider when to sell your inherited property. There are both good and bad times to sell a property. See below for more information.

Related: The best time to sell your property

The best practice, in this case, would be to evaluate your own personal circumstances and then pick a selling option. A home buying company will be right for you if you need a quick cash sale. On the other hand, if you want to sell up and have time on your side, then an estate agent might be the better option.

7) Pay your taxes

Once it’s all worked out concerning what type of taxes you would have to pay in order to sell your inherited house, it’s time to proceed with payment.

Once the taxes have been paid, you can officially consider the transaction closed and the house sold.

Most of the time, the sale of an inherited house is a tedious and complex process that, more than anything it needs time and patience to be completed.

The best practice, in this case, would be to exercise due diligence to ensure you're aware of which taxes you need to pay when you need to pay them and that you're paying the correct amount.

The Final Word

Selling your inherited property can be a complicated process, especially for those who have never been on the property ladder & don't have any experience.

It can quickly become a tough task as there are many legal hurdles one must overcome in addition to dealing with losing a family member or relative. Furthermore, this topic is not something we're taught about, so the only natural way to learn about it is "on the job" when you're actually going through it.

Given the fact that many of us are not familiar with concepts such as inheritance tax, capital gains tax, income tax, will, probate, and so on, it’s self-explanatory that during these challenging times, one may want to make light of the legal nebula that surrounds the inheritance issue without too many difficulties.

That said, we're confident that if you remain vigilant, perform due diligence & follow our 7-step process, you'll have little to no trouble selling your inherited property.