Selling your House Due to Financial Difficulties: Get Fast Solutions

Updated: June 2025

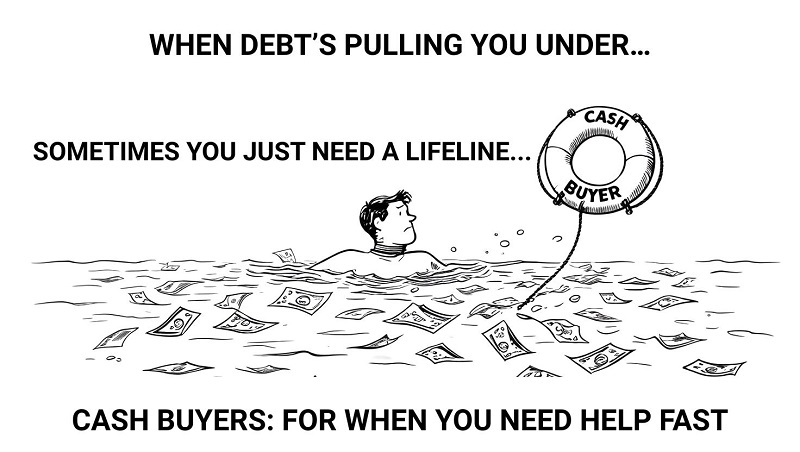

If financial difficulties mean you’re struggling to keep up with bills, mortgage payments, or debts, selling your home quickly can be an effective solution to regain control and avoid deeper financial trouble.

Key Takeaways:

- Financial problems often leave homeowners needing a fast sale.

- Selling your home quickly can stop debts from spiralling out of control.

- Specialist cash-buying services can provide a swift, hassle-free sale.

-

- What Counts as Financial Difficulties When Selling a House?

- How to Quickly Sell Your House Due to Financial Issues

- Financial Difficulties That Lead Homeowners to Sell

- How Selling Your House Quickly Can Help Ease Financial Strain

- Need to Sell Your House Quickly Due to Financial Difficulties?

- Frequently Asked Questions

What Counts as Financial Difficulties When Selling a House?

Financial difficulties refer to any situation where a homeowner struggles to afford essential costs, such as mortgage payments, due to challenges like job loss, redundancy, mounting debts, divorce, illness, retirement, or unexpected bills. These circumstances can lead to missed payments, arrears, and even potential repossession, often leaving homeowners with no choice but to sell quickly to regain financial stability.

How to Quickly Sell Your House Due to Financial Issues

Selling a problem property can feel daunting, but there are clear steps you can take to maximise your chances and avoid costly delays:

-

Evaluate Your Situation: Take an honest look at your finances, debts, and how urgent your need to sell really is. Knowing exactly what you owe and how quickly you need funds will help you make the right decisions.

-

Get a Fast Valuation: Request a valuation from local estate agents and at least one reputable cash-buying company. This will give you a realistic idea of what you can expect to receive, especially if your property needs to sell quickly.

- Choose the Best Selling Method: Some of the most popular selling methods include selling on the open market, auction houses and house buying companies that pay cash.

-

Prepare Essential Paperwork: Have your mortgage statements, property deeds, ID, and any relevant documents (like planning permissions or arrears letters) ready. This speeds up the sale and avoids delays.

-

Accept an Offer and Understand Legal Considerations: Review offers carefully, checking for hidden fees and the buyer’s ability to move quickly. With a genuine cash buyer, there’s usually less risk of the sale falling through, and you’ll benefit from a faster, more straightforward process.

-

Complete the Sale and Settle Debts: Once you accept an offer, your solicitor will guide you through the final paperwork. Use the sale proceeds to clear outstanding debts, mortgage arrears, or other urgent bills, helping you move forward with peace of mind.

Financial Difficulties That Lead Homeowners to Sell

1) Mortgage Arrears or Risk of Repossession

Falling behind on mortgage payments can quickly put your home at risk of repossession. Acting fast by selling your property can clear mortgage arrears, stop court action, and prevent losing your home entirely.

According to The Guardian with data from StepChange Debt Charity, average mortgage arrears among their clients escalated from £6,054 in 2023 to £10,239 in 2024—a staggering 69% increase. This sharp rise underscores the mounting financial pressures homeowners face, often leading them to consider selling their properties to avert repossession.

2) Job Loss, Redundancy, or Reduced Income

If you’ve lost your job or face reduced earnings, maintaining your current lifestyle can quickly become unsustainable. Selling your house can give you the funds needed to stabilise your situation, while you rebuild your finances.

3) Costly Divorce or Separation

Divorce or separation often comes with heavy legal fees and the burden of splitting shared assets. Selling your property can provide funds to cover costs, allowing both parties a clean break and financial independence.

4) Accumulating Debts (Credit Cards, Loans, Tax)

Mounting debt from loans, credit cards, or unpaid tax can quickly spiral out of control. Selling your home can help you:

-

Clear large, high-interest debts.

-

Avoid further penalties or legal action.

-

Regain control over your financial situation.

For the first time, total household debt in the UK has surpassed £2 trillion, equating to approximately £71,000 per household. This milestone indicates the extensive financial strain on households, prompting many to liquidate assets, including their homes, to manage and reduce debt burdens

5) Rising Utility Bills or Unexpected Expenses

Unexpected bills like sudden repair costs or surging energy prices can quickly tip your finances into crisis. Selling your property can give you immediate cash, helping you manage these sudden financial burdens before they escalate further.

6) Retirement or Reduced Pension Income

Entering retirement or experiencing a drop in pension income can drastically reduce your financial flexibility. Options to stabilise your finances include:

-

Selling your home and downsizing.

-

Reducing monthly living costs.

-

Use the proceeds to strengthen your retirement fund.

7) Health Issues Causing Loss of Earnings

Health problems that reduce your ability to work can rapidly push you into financial difficulties. Selling your home can provide essential funds to support your living costs and treatment, while you recover without financial stress.

8) Moving Out on Your Own

Many underestimate the financial burden of living independently, leading to unexpected debt or unmanageable expenses. Selling your current home can:

-

Free up equity to fund the transition comfortably.

-

Allow you to move into more affordable accommodation.

-

Prevent debt from accumulating as you adapt to new living costs.

9) Bereavement and Loss of Household Income

Losing a family member often means a sudden drop in household income, placing extra financial pressure during an already difficult emotional time. Quickly selling the property can help cover immediate costs, clear debts, and give you space and resources to adjust to your new circumstances.

How Selling Your House Quickly Can Help Ease Financial Strain

Selling your house quickly can provide the immediate funds needed to clear mortgage arrears, pay off mounting debts, and cover urgent bills stopping interest and penalties from piling up any further. By acting fast, you can avoid repossession or legal action, prevent your financial situation from getting worse, and give yourself a clean slate to rebuild and move forward.

Expert insight from our Property Specialist, Paul:

"I’ve seen firsthand how selling quickly can make all the difference for homeowners under financial pressure. When debts are growing and arrears are mounting, a fast sale doesn’t just stop the stress it can help you clear the slate and start fresh. Acting early is often the key to avoiding repossession and taking back control."

Learn More About How to Sell Your House Fast in the UK

- Best Time of the Year to Sell Your House

- Should I Sell My House to Pay Off Debt?

- Selling Your House After Divorce

- How to Sell an Inherited Property Fast

- Sell House Due to Job Relocation

- Selling your House Due to Health Issues

- Selling a House in Poor Condition

- How to Sell a House with Bad Tenants

- How to Sell your Tenanted Property

- How to Sell My Flat Quickly

- How to Sell Your House to an Investor Fast

- How to Sell your House Online

- Selling Your House Without an Estate Agent in the UK

- How to Sell your Empty House Fast in the UK

- Common Mistakes When Selling Your Home

- Selling your Non-Standard Construction House

- How to Stage a House for Sale

- Sell My House Fast for Market Value UK

- How Long Does It Take to Sell a House UK?

- Selling a House in Poor Condition

- What is Gazundering?

- Selling Your House Due to Relocation or Emigration?