What Does Cash Buyers Only Mean & is it Safe?

‘Cash Buyers Only’ means the seller will only accept offers from buyers who can pay in full upfront, without a mortgage. This helps avoid delays, chain breaks, and financing risks, making the sale faster and more secure.

Key takeaways:

- Not all ‘Cash Buyers Only’ homes have issues; some sellers want a faster, secure sale.

- Cash buyers have negotiation power and often expect a discount for speed and certainty.

- Proof of funds is crucial, so sellers should verify bank statements or solicitor confirmation.

What Does Cash Buyers Only Mean?

The term "Cash Buyers Only" specifically refers to a scenario where sellers prefer buyers who can pay the full amount upfront, without the need for mortgage financing. On the flip side, a cash house buyer is an individual or entity ready to purchase a property outright with cash. Understanding these terms is fundamental as they dictate the transaction's pace and often the asking price.

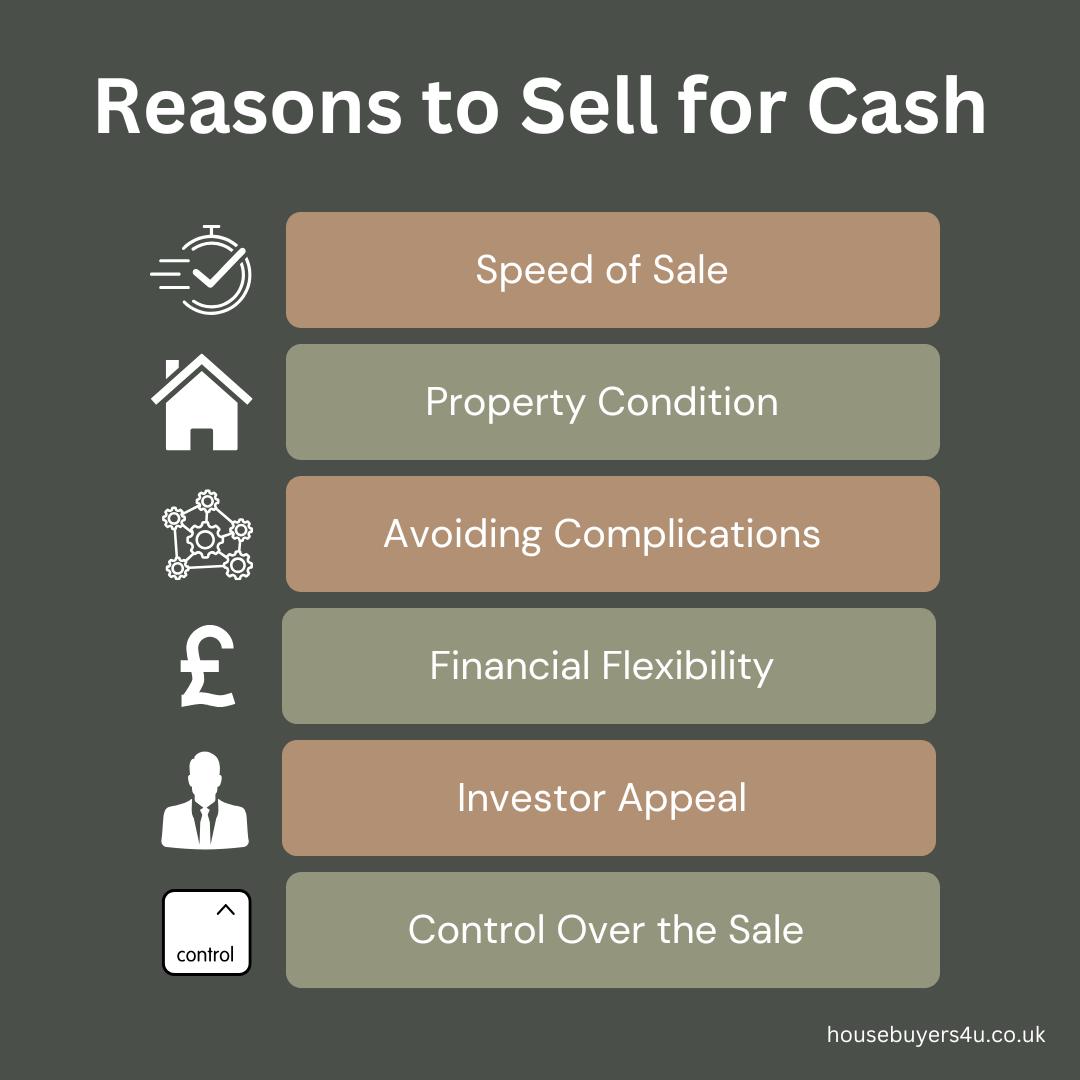

Why Would Someone Sell a House for Cash?

Selling a house for cash isn’t always a sign of a problem property. While some homes may need extensive repairs, there are several other reasons sellers opt for a cash-only sale.

-

Speed of Sale: Cash transactions are significantly faster than mortgage-based sales, which can take months due to lender approvals and property chains. Sellers who need a quick, hassle-free sale often prefer cash buyers.

-

Property Condition: Some properties have structural issues or require major renovations, making them difficult to mortgage. Rather than investing in repairs, owners may choose a cash sale for a smoother transaction.

-

Avoiding Complications: Sellers who have lost a previous buyer due to mortgage delays or who face repossession may list as cash buyers only to secure a reliable and fast sale.

-

Financial Flexibility: Some homeowners prioritise certainty over price, accepting a lower cash offer to avoid prolonged market exposure or financial uncertainty.

-

Investor Appeal: Properties in need of refurbishment often attract cash buyers looking to renovate and sell or let. These buyers are ready to proceed immediately, making them an attractive option for sellers.

-

Control Over the Sale: Choosing a cash buyer reduces risks and delays, allowing sellers to finalise the transaction on their terms without the uncertainty of mortgage approvals.

Why Do Some Properties Say Cash Buyers Only?

A reason why a property would be cash only is that some are difficult to mortgage due to specific issues, making them suitable only for cash buyers. Here are the most common reasons:

- Serious Structural Issues: Properties with subsidence, bowing walls, or unstable foundations often fail mortgage lender inspections.

- Fire or Flood Damage: Homes requiring extensive repairs after fire or water damage are seen as high-risk by lenders.

- Japanese Knotweed: This invasive plant can damage buildings and devalue properties, leading most mortgage lenders to reject affected homes.

- Short Leasehold Properties: If a lease has less than 80 years remaining, mortgage lenders may refuse to finance the purchase.

- Non-Standard Construction: Homes built with steel frames, prefabricated materials, or unusual designs can be hard to insure and mortgage.

- Ex-Local Authority Flats: Some lenders hesitate to approve mortgages for flats in high-rise council buildings due to historical resale difficulties.

- Derelict or Abandoned Properties: Homes in severe disrepair that require major renovations are often sold to cash buyers.

- Unusual or High-Risk Locations: Properties near landfill sites, flood-prone areas, or industrial zones can be flagged as too risky by lenders.

Many homeowners facing these challenges choose a cash sale to avoid delays and uncertainty. Here’s how one seller benefited from a quick, hassle-free cash transaction:

Housebuyers4u & Raymond Moore, was extremely helpful for my type of situation and guided me in the right direction friendly and knowledgeable

Click here to read the full review on Trustpilot

Expert advice from our property expert Paul

"We've seen many sellers struggle because their property doesn’t meet mortgage lender requirements. If your home has structural issues, a short lease, or even something like Japanese Knotweed, selling to a mortgage buyer can be near impossible. The key is to be proactive—get a structural survey if needed, check if lease extensions are possible, and be upfront about any issues to avoid wasting time with buyers who can’t proceed.

That’s why we buy these properties outright with our own funds—no delays, no uncertainty, just a guaranteed sale. Sellers come to us because they need a fast, secure option, and we make sure they get exactly that."

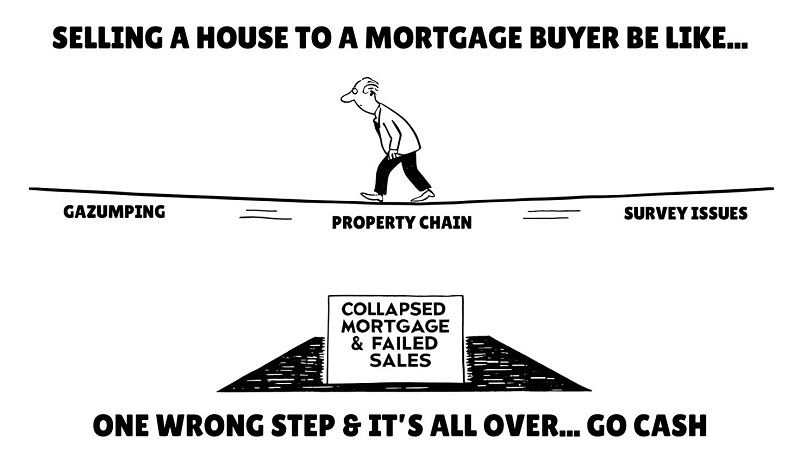

Should You Sell to a Cash Buyer or Wait for a Mortgage Buyer?

The choice between a cash buyer and a mortgage buyer affects speed, security, and negotiation power in a property sale.

According to Property Industry Eye, 31.3% of property sales fell through in Q1 2024, with 20% due to mortgage issues and 8% from chain collapses. Selling to a cash buyer removes these risks, ensuring a faster, more secure transaction.

Advantages of Selling to a Cash Buyer:

-

Speedy Transactions: Cash buyers can close deals swiftly, often within a few days, which is beneficial for sellers in urgent situations.

-

Fewer Complications: There's less likelihood of issues related to loan approvals, which minimises stress when selling up.

-

No Risk of Financing Fall-Through: With cash buyers, sellers avoid the risk of the deal falling apart due to failed financing.

Key Differences Cash Buyers vs. Mortgage Buyers

| Key Aspect | Cash Buyers | Mortgage Buyers |

|---|---|---|

| Speed | Fast – can be completed within days | Slow – mortgage approvals take weeks/months |

| Certainty | Higher – no risk of financing fall-through | Lower – lender can reject mortgage last-minute |

| Negotiation Power | Higher – sellers may accept lower prices for certainty | Lower – mortgage delays reduce bargaining power |

| Closing Costs | Lower – avoids lender fees | Higher – includes lender & legal fees |

| Long-Term Costs | None – no interest payments | Higher – mortgage interest adds to total cost |

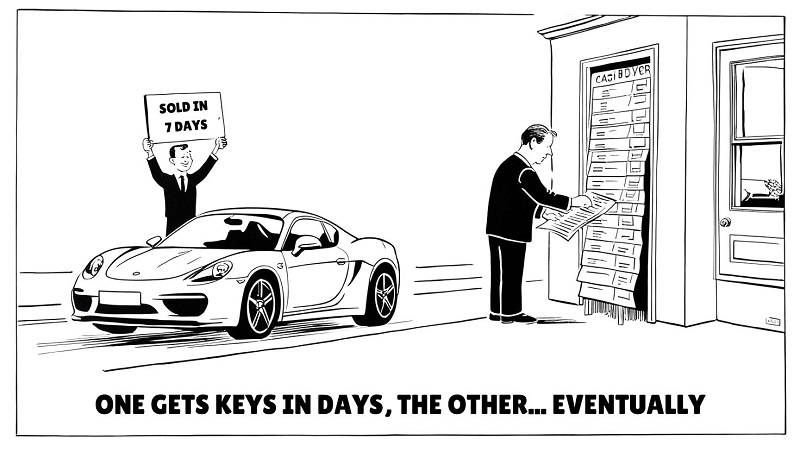

Should You Sell Your Home for Cash?

Selling your home for cash offers speed, certainty, and simplicity, making it ideal if you're facing financial difficulties, have an unmortgageable property, or want to avoid a lengthy sale.

At Housebuyers4u, we specialise in fast, guaranteed cash sales, offering homeowners a way to sell without delays, chains, or uncertainty. Unlike traditional estate agents, we provide a genuine cash offer with no hidden fees, allowing you to complete in as little as 7 days. Whether your property needs work, has legal complications, or wants a quick sale, our service ensures a stress-free and efficient process.

If you're considering selling for cash, we offer a reliable, secure, and transparent way to move forward—without the usual risks of buyer fall-throughs or lengthy negotiations.