Best Companies that Buy Houses (Over 23 UK firms Analysed)

Last updated: January 2025

Good news, our property experts have researched & ranked the top 23 companies that buy houses in the UK, so you don’t have to.

The latest data shows that over 32.8% of houses were bought for cash in 2024, many via house-buying companies. How much do they pay? Who are actually legitimate cash buyers with their own funds and good reviews & reputation?

Let's see who made the cut.

-

- Revealed: UK's Best House Buying Company

- How Much do they Pay for your Home in 2025?

- Is it Worth Selling to a House Buying Company?

- Key Questions to Ask

- How to Check if You're Dealing with a Reputable Company

- Regulations, Memberships & Code of Practice

- How to Spot Scams & Fraudulent House Purchasing Companies

- Types of Companies that Buy Houses

- Quick Sale Companies vs Estate Agents

- How Companies that Buy your House Work

- Compare House Buying Companies

The Best House Buying Company is

Choosing the right house-buying company is a big decision, and we’re here to help you make it with confidence. After carefully reviewing the best cash house buyers in the UK, we’ve evaluated their reputation, experience, seller feedback and how they fund their purchases.

Housebuyers4u, one of the oldest and most reputable UK based We Buy Any House companies, known for operating ethically with transparent advice & offers.

Crucially, they are genuine cash buyers that utilise their own funds to buy property. They will buy any house in any condition and can complete a house sale in as little as 7 days, here are some real case studies of previous customers.

Their unbeatable "completion guarantee" sets them apart from competitors - they are the only firm to offer this perk.

They are registered with the Property Ombudsman & the National Association of Property Buyers and follow the TPOS code of practice.

Housebuyers4u has had its expertise published in multiple national newspapers such as EstateAgentToday, The Metro and The Daily Mail.

They have some of the highest review scores across multiple websites: Trustpilot, Feefo & Google. Read more via the Housebuyer4u reviews page.

HouseBuyFast is a home-buying company with its main office based in Worthing, founded in 2008.

- Offers a cash offer of 75-85% of market value and claims a completion time as fast as 3 days.

- As of January 2025, they have 352 reviews on Trustpilot with a score of 4.4.

- Their co-founder, Jonathan Rolande, is well-known and respected in the property space.

Our Rating: 4/5

Read our entire HouseBuyFast review.

Quick Move Now, established in 1998 and headquartered in Swindon, is recognised for its rapid, cash-based property-buying services.

- Offers a cash offer of 80-85% of market value with a typical completion time of 7-21 days.

- As of January 2025, they have 99 reviews on Trustpilot with a score of 4.4.

- Generally are ethical practitioners and members of The Property Ombudsman (TPO).

Our Rating: 4/5

Read the full Quick Move Now review.

We Buy Any House, headquartered in Didsbury, Manchester, operates nationwide across England, Scotland, and Wales.

- Offers up to 90% of market value with the potential to complete sales within 7-28 days.

- Covers valuation and legal fees, providing a hassle-free cash-buying service.

- As of May 2024, has 387 Trustpilot reviews with a score of 4.4 and 25 Reviews.io reviews with a score of 4.7.

Our Rating: 4/5

Read our full We Buy Any House review.

Want the full picture? See how all 23 companies stack up in our detailed comparison table

How Much do they Pay for your Home in 2025?

Unfortunately, even with a traditional estate agent, you likely won't get full market value but for cash buyers.

In 2024 alone, 32.8% of home sales were to cash buyers, most citing ‘speed’ and ‘certainty’ as the top motivators for bypassing traditional estate agents.

5 Year offer analysis

| Year | Average Price Offered |

|---|---|

| 2021 | 78-88% |

| 2022 | 75-87% |

| 2023 | 74-86% |

| 2024 | 74-85% |

| 2025 | 73-85% |

We studied market trends over the past 5 years and observed that the average percentage of market value offered by house-buying companies has remained steady, ranging from 73% to 85%.

In 2025 specifically, a home buying company's below market value offer will be approximately 73% to 85%.

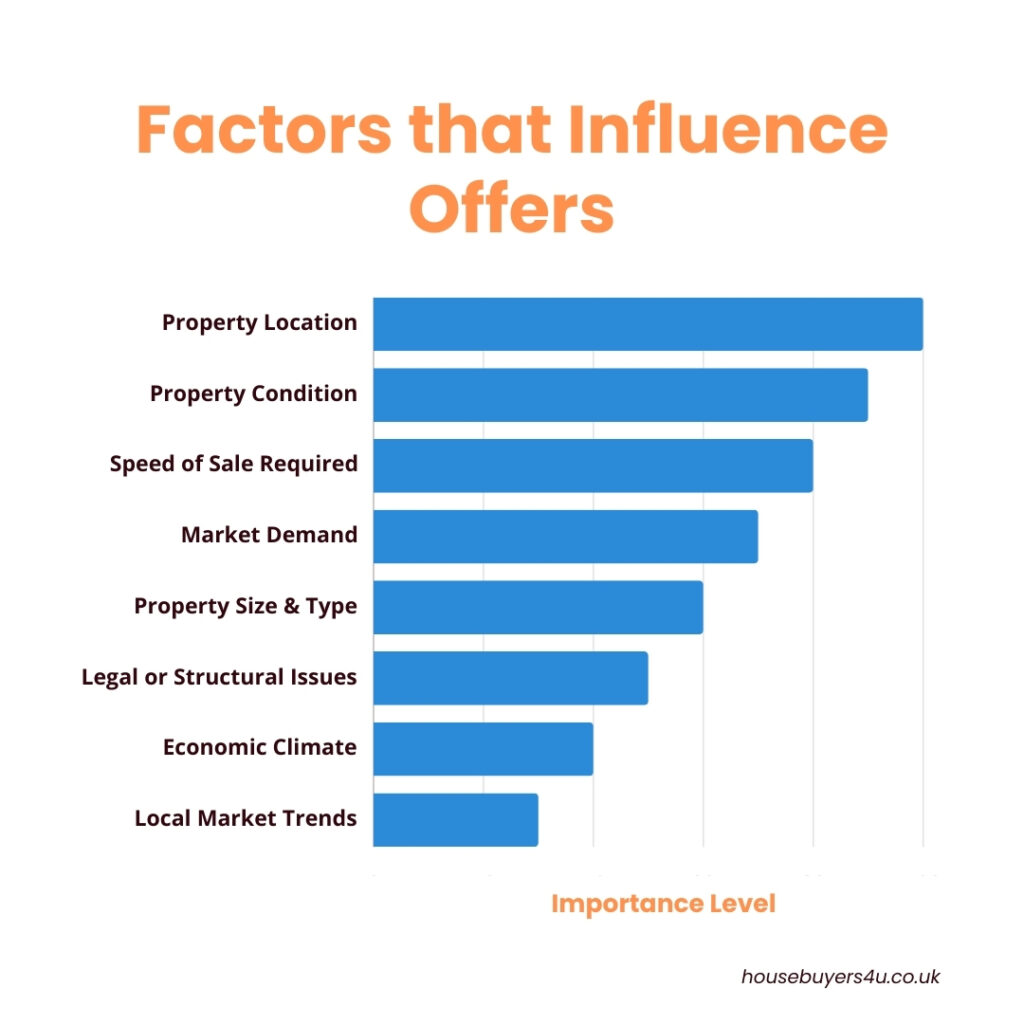

Maximising your offer price: What factors influence your offer

This chart further breaks down the crucial factors, explaining why the above factors carry the weight they do. Although quite a few will be out of your control, you can use these insights to make a difference in your property's valuation and sale price.

| Factors that Influence Offers | How they can Affect the Offer Price |

|---|---|

| Property Location | Prime locations often fetch higher offers |

| Property Condition | Better condition properties can lead to higher offers |

| Speed of Sale Required | Urgent sales might reduce the offer price (7 days or less) |

| Market Demand | High demand can increase the offer price |

| Property Size & Type | Larger or unique properties might get better offers |

| Legal or Structural Issues | Big issues can significantly lower offer prices |

| Economic Climate | Economic downturns might lower offer prices |

| Local Property Market Trends | Local market strength can influence offers |

Related Read: What is my house worth in 2025?

Key Questions to Ask When Considering a Property Buying Company

When considering a quick sale company, you can ask questions such as:

- Who is buying the property?

- How will they pay?

- What are the timescales for the sale?

- What fees and charges will you have to pay?

- Are they members of the NAPB?

We studied customer reviews and found that sellers who asked detailed questions about fees, timelines, and guarantees were 35% more satisfied with their experience. Transparency early in the process significantly reduces misunderstandings and ensures a smoother sale.

How to know if you're Dealing with a Reputable firm (Checklist)

There are many so-called 'direct payment buyers' out there, and their names include 'sell', 'quick', 'fast', and more. Despite using these types of phrases, many of these companies don't offer a true cash sale.

Our property sale team have put together 12 critical checks you can do to verify if a property-buying company's offer is legitimate & that they are a trustworthy firm to deal with.

When engaging with a company that buys houses, keep the following in mind:

| Check | Action |

|---|---|

| 1. Confirm they can Make a Cash Purchase | Verify that the company has readily available cash funds. Request a recent bank statement, a letter from a Law Society-accredited solicitor, or an undrawn debt facility. |

| 2. Confirm a Chain-Free Transaction | Ensure the company is a legitimate buyer that operates with no property chain, meaning they don’t rely on dependent sales to purchase your property. |

| 3. Check the Company’s Reviews & Support | Look for legitimate client reviews and feedback. A reputable company should gladly connect you with past clients and showcase strong customer support. |

| 4. Verify No Hidden Fees or Charges | Confirm there are no hidden fees for estate agency, legal, or administrative costs. The offer price should match what you receive upon completion. |

| 5. Look Up the Quick Sale Company | Perform a Google search for the company and its directors. Look for any signs of a bad reputation or negative feedback. |

| 6. Check for Option Agreements | Avoid signing option or lock-in agreements, as they may not be in your best interest. Most sellers prefer a straightforward, guaranteed cash sale. |

| 7. How Long Has the Company Been in Business? | Investigate the company’s track record for completing sales within stated deadlines. Consult your conveyancer for further confirmation. |

| 8. Verify Information via Companies House | Check Companies House to review the firm’s latest account submissions. Be cautious of companies with similar names imitating reputable organisations. |

| 9. Proven Record of Success | Ask about the company’s track record for meeting sale deadlines. Consult your conveyancer or ask the company directly for proof. |

| 10. Check Registered Address | Ensure the company has a legitimate and verifiable office address. |

| 11. Transparency in the Valuation Process | Understand how the company conducts property valuations. Confirm that the process is transparent and fair. |

| 12. Accreditations and Memberships | Verify if the company is a member of legitimate professional bodies or has recognised industry accreditations. |

Read our full, step-by-step company reputation check guide here

It’s crucial to work with a reputable house buying company that uses their own funds to avoid falling victim to we buy any house scams that could cost you time and money. At HouseBuyers4u, we recommend checking a company’s accounts by asking who their underwriters are and verifying them through Companies House.

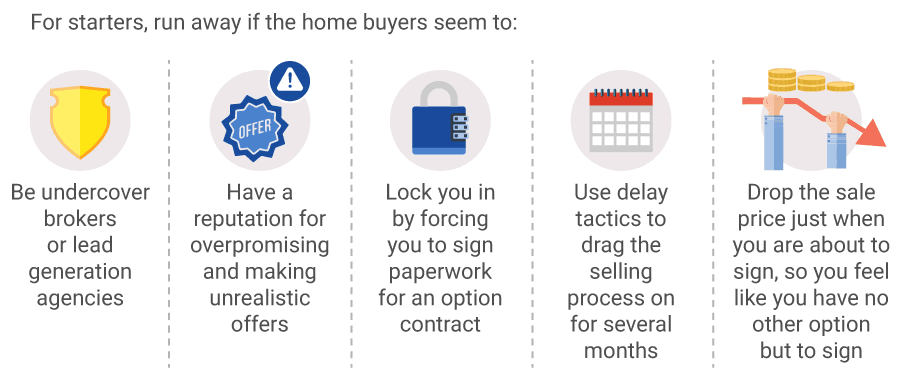

Run away if the dodgy traders illude or seem to:

- Undercover Brokers or Lead Generators: Be wary of companies that don’t actually buy houses but collect your details to sell them to genuine buyers. Watch out for option agreements or long delays.

- Fake or Excessive Reviews: If a company has an unusually high number of short or poorly written reviews, or if reviewers only have one review, they could be fake.

- No Industry Registration: Legitimate companies should be members of the Property Ombudsman (TPO) or the National Association of Property Buyers (NAPB).

- Over-Promising Offers: Avoid companies known for making unrealistic offers that are later reduced. Check reviews for past customer experiences.

- Option Contracts: Don’t sign agreements that give them control over your property without a guaranteed sale.

- Delay Tactics: Some firms use survey delays, fail to release funds, or drag out paperwork to stall the process.

Attention: Beware of Excessively High Offers that seem too good to be true

A typical scam involves the company's sales agent presenting seemingly high initial offers. This strategy is designed to build your hopes and secure a commitment.

When you're set to move, they abruptly insist on a lower price before proceeding with the exchange and completion, a practice known as "gazundering."

While walking away is an option, many sellers, facing financial constraints or eager to sell the property, reluctantly agree to these reduced terms.

The Truth About "We Buy Any House in any condition" Claims

Our research reveals a different reality behind these advertisements. Most cash buyers actually won't purchase:

- Properties with serious structural issues (like subsidence)

- Homes with Japanese knotweed

- Short leases under 80 years

- Complex probate cases

- Certain commercial properties

- Mixed-use types of houses

We advise you let any buyers know of any specific abnormal issues before signing, as this could cause upsets on both sides later in the process.

Note: The above is normal if the company states their offer is only an "initial offer subject to survey".

Here’s how our expertise and commitment to transparency have helped homeowners like Helene stress-free sale:

The Housebuyers4u team actually did what they said they would, communicated well and helped get us over the line to completion today. Sincere and honest people in what can be quite a sharky industry!

What are House Buying Companies?

House buying companies are businesses that purchase homes directly from sellers, often for cash, providing a faster and more secure alternative to traditional estate agents or property auctions. These companies typically offer below market value but compensate by ensuring a quick sale, flexible completion timelines, and the ability to buy properties in any condition, including those with structural issues or other challenges

Types of Companies that Buy Houses for Cash

When selling your house quickly in the UK, you'll find these three main types of buying companies:

- Genuine Cash Buyers - These reliable companies have their own money ready and can buy your house outright within 2-4 weeks, making fair offers without any loan approvals needed.

- Non-Genuine Cash Buyers - Be cautious of these firms that make empty promises, undervalue properties, and often lack the actual funds to complete purchases.

- 'Advisory' Companies - These middlemen pose as property advisors but aim to buy your house cheap and sell it on to genuine buyers for a profit, leaving you with less money.

When considering cash buying company, it's important to understand how different buyers might value your property. The following table provides a comparison of potential offers from various types of buyers, based on a UK property with a current market value of £300,000.

| Service Provider | Service Fee | Typical Offer Range | Offer Amount (£300k House) |

|---|---|---|---|

| Traditional Cash Buyer | None | 70-80% of market value | £210,000 - £240,000 |

| iBuyer | 5-6% | 90-95% of market value | £270,000 - £285,000 |

| Cash Buyer Marketplace | £500-£1000 | Up to 100% of market value | Up to £300,000 |

| Home Trade-In Service | Varies | 85-95% of market value | £255,000 - £285,000 |

House Buying Companies vs Estate Agents

The difference between selling to a cash house buying companies and through an estate agent is quite significant in terms of process, time, and sometimes, the financial outcome.

- Process and Timeframe: When selling to a cash buyer, the process is usually much quicker and involves fewer steps. There's no need to market the property, host viewings, or wait for a buyer's mortgage approval. In contrast, selling through an estate agent involves these steps and can take much longer.

- Financial Considerations: Cash buyers often purchase homes at a lower price point, as they usually offer to buy the house 'as-is', without requiring repairs or renovations. Estate agents aim to get the best market value for your property, which might be higher but also comes with additional costs like agent fees and potentially longer mortgage payments due to the extended selling time.

- Certainty of Sale: With cash buyers, once the offer is accepted, the sale is almost guaranteed. However, with estate agents, there's a risk of sales falling through due to factors like failed mortgage applications or changes in buyer's circumstances.

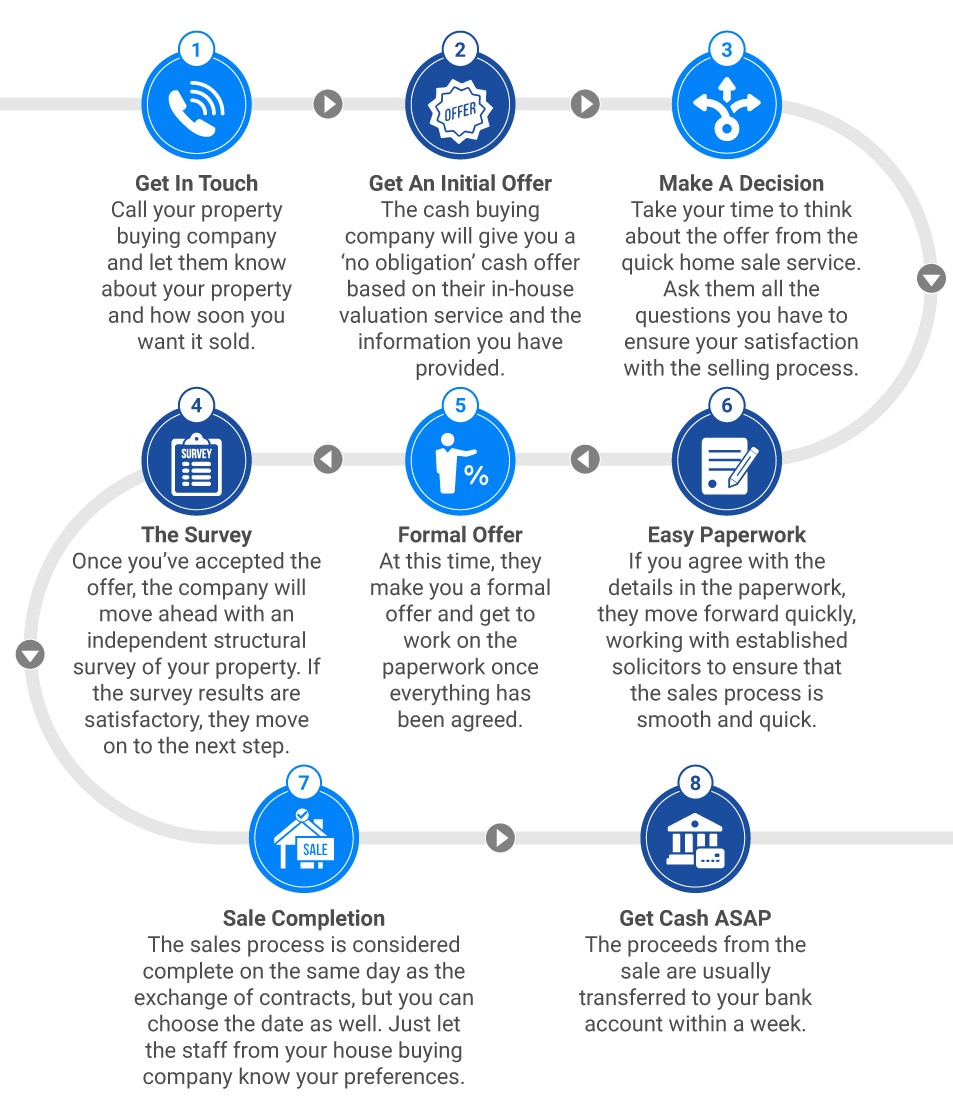

How Companies that Buy your House Work

How the process works in 8 easy steps that guarantee completion.

Selling your home is a big decision—I understand that. You want it to go smoothly and feel worthwhile. But let’s be honest, traditional ways of finding a buyer can take forever, especially in a slow market. That’s where quick house sale companies can help. They offer a simple, hassle-free process, with sales completed in as little as 21 days. If you’re looking for a faster, stress-free way to move forward, this could be the ideal solution.

Additionally, selling your property to house buyers is straightforward, here's how it goes:

1) Get In Touch: : Call the firm and tell them about your property and how soon you want to sell it.

2) Get An Initial Offer: The company will give you a no-obligation cash offer based on their in-house valuation service and your provided information.

3) Make A Decision: Take your time to think about their offer. Ask them as many questions as you need to ensure your satisfaction with the selling process.

4) The Survey: Once you’ve accepted the offer, the company will conduct an independent structural survey of your property. If the survey results are satisfactory and show no signs of major issues such as structural damage, damp issues, infestations, or no building regulation approval for extensions, then they move on to the next step.

5) Formal Offer: At this time, they will send you a written formal offer and go ahead with

the paperwork once you express your agreement.

6) Easy Paperwork: If you agree with the details in the paperwork, they move forward quickly, working with established solicitors to ensure that the sales process is smooth and quick. Companies will also cover costs such as conveyancing and solicitor’s fees. These can typically amount to up to £500-1000.

7) Sale Completion: The sales process is considered complete on the same day as the exchange of contracts, but you can choose the date as well. Just let the staff from your

company know your preferences.

8) Get Cash ASAP: The proceeds from the sale are usually transferred to your bank account within a week.

Expert advice from our property expert Paul

My advice to anyone in a similar position is to ask lots of questions—don’t hesitate to make sure you fully understand the timeline and offer details before committing."

| House buying company | Trustpilot score | Google score | Feefo score |

|---|---|---|---|

| Housebuyers4u | 4.8 | 4.7 | 4.7 |

| HouseBuyFast | 4.0 | 4.7 | 4.8 |

| Quickmovenow | 4.3 | 4.4 | 4.9 |

| Goodmove | 4.9 | 4.8 | No reviews |

| Property Solvers | 4.7 | 4.8 | No reviews |

| National Homebuyers | 4.5 | 4.1 | No reviews |

| Open Property Group | 4.7 | 4.3 | 4.9 |

| British Home Buyers | 4.9 | 4.9 | No reviews |

| Ready Steady Sell | 3.7 | No reviews | No reviews |

| We Buy Now | 4.4 | 4.1 | No reviews |

| SpringMove | 4.5 | No reviews | No reviews |

| TheAdvisory | No reviews | 5.0 | No reviews |

| Ask Susan | No reviews | 2.3 | No reviews |

| Property Cash Buyers | 1.3 | No reviews | No reviews |

| We Buy any Home | 4.0 | 3.9 | No reviews |

| Home House Buyers | 4.9 | 4.9 | No reviews |

| Smooth Sale | 4.9 | 4.9 | No reviews |

| Upstix | 4.0 | 4.2 | No reviews |

| Express Offers | 4.1 | No reviews | No reviews |

*Note: Review data is usually less than 12 months old, please click and read the individual reviews above for up to date details on each website.

Further reading

Understanding how quick sale companies work

Yes 100%. Selling your house to a cash buyer is legal and recognised in the UK property market, there are some key differences to be aware of compared to traditional sales:

Process Simplification: The sale process is generally quicker and involves less paperwork since there's no need for mortgage approval.

No Mortgage Implications: Cash buyers don't require a mortgage, so the sale is not contingent on loan approvals, making the process smoother and reducing the risk of the sale falling through.

Use of Solicitors: The legal process remains largely the same, with solicitors handling the transaction. However, it can be more streamlined as fewer parties are involved.