How to Get a Fair Valuation on Your House (2025)

To get a fair valuation from a house-buying company, understand exactly how they calculate your property's value, request a detailed written valuation report, and independently verify comparable local sales before accepting any offer.

Key Takeaways:

- Understand exactly how the company calculates your home’s value.

- Request a detailed, written valuation report.

- Double-check comparable sales independently before accepting any offer.

What is a Fair Valuation?

A fair valuation is a realistic and unbiased assessment of your property's current market value, based on recent sales of similar homes in your area, professional appraisal standards, and transparent valuation methods. It ensures you're offered an accurate and justified price that truly reflects what your home is worth, protecting you from undervaluation or misleading offers.

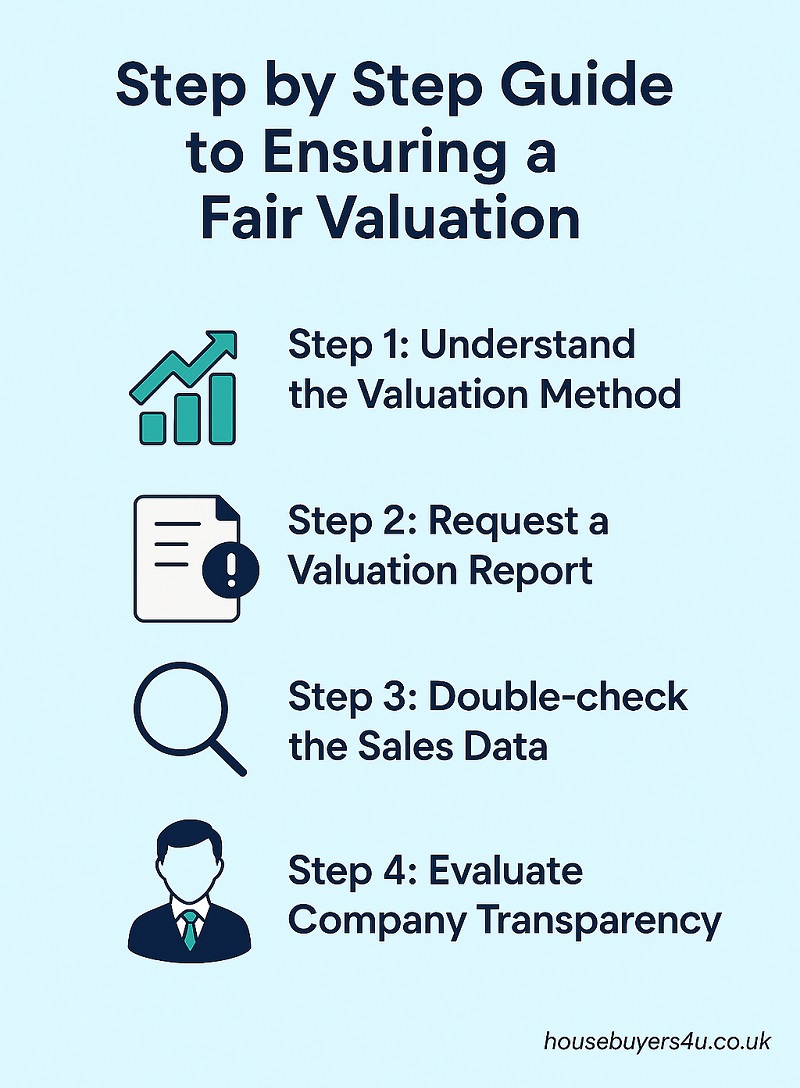

Step by Step Guide to Ensuring a Fair Valuation

Step 1) Understand the Valuation Method They Use

Ask the company to explain the method they use to value your property. This can include comparative market analysis, professional appraisals, or automated valuation models.

Related: What is my house really worth?

What to Do:

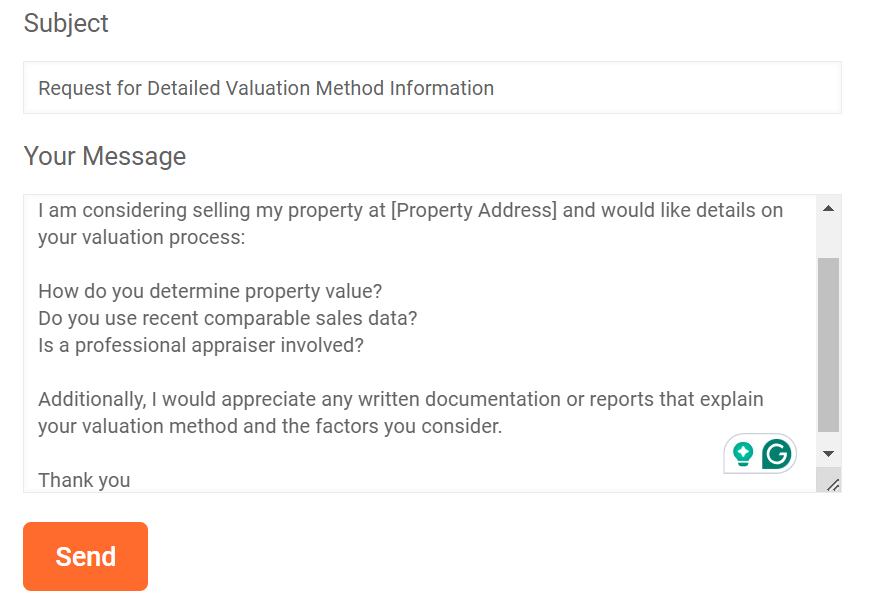

-

- Reach out via email or phone to request detailed information on their valuation process.

-

Ask Specific Questions:

- How do they determine the value of properties?

- Do they use comparable sales data from recent transactions in your area?

- Is a professional appraiser involved in the valuation process?

-

Get Written Documentation:

- Request written documentation or a report explaining their valuation method and the factors they consider.

Why It Matters: Understanding the valuation method provides clarity on how the company determines the offer price, ensuring it is based on fair and standard practices. This transparency helps you gauge whether the valuation is fair and in line with market conditions, ultimately protecting your interests in the house selling process.

Advice from our Property Expert, Paul Gibbens:

“I always tell homeowners: don’t just accept a number, ask exactly how they arrived at it. If a company can’t explain their valuation process clearly or provide it in writing, that’s a red flag. You deserve transparency, so don’t be afraid to keep asking questions until you feel comfortable with their answer.”

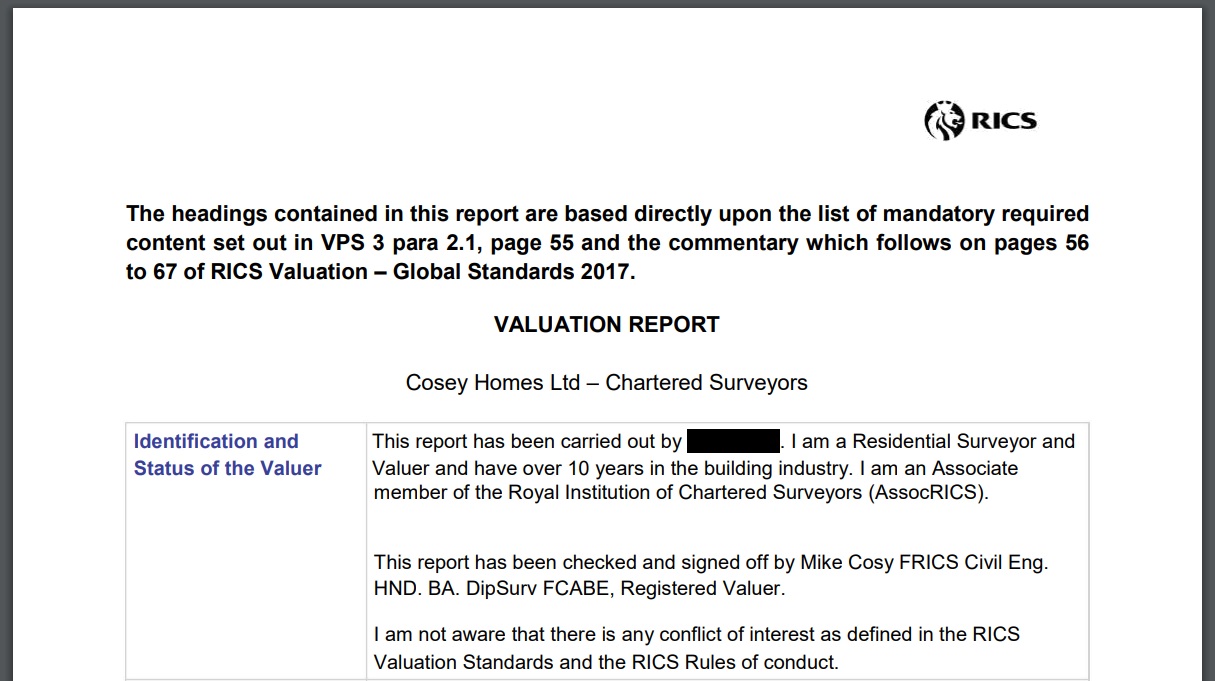

Step 2) Request a Detailed Valuation Report

Click here for the full sample report from cosyhomes

Obtain a detailed valuation report from the company outlining the key factors and data points used to determine your property’s value.

What to Do:

-

Request the Report:

- Ask for a comprehensive report that includes comparable sales, market conditions, and specific property details.

-

Review the Data:

- Check if the report includes recent sales of similar properties in your area.

- Ensure the data used is up-to-date and relevant.

-

Ask for Clarifications:

- If any part of the report is unclear, ask the company for further explanation or additional details.

A detailed valuation report gives you insight into how the company arrived at their offer price and ensures the valuation is based on accurate and transparent data. This transparency helps you understand whether the offer is fair and reflects current market conditions, providing peace of mind and confidence in the sale process.

Step 3) Double-check the Sales Data

divider height="20"]

Independently check recent sales in your area to confirm the accuracy of the comparable sales data used in the valuation report.

What to Do:

-

Use Online Resources:

- Utilise property websites like Rightmove, Zoopla, or the Land Registry to find recent sales data for properties similar to yours.

-

Compare Key Metrics:

- Check the prices, locations, sizes, and conditions of the comparable properties used in the company’s report.

- Look for properties that are as similar as possible to yours in terms of location, size, condition, and sale date.

-

Validate the Information:

- Ensure that the data points match what the company has provided and are reflective of current market trends.

- Double-check any discrepancies or unusual data points by looking at multiple sources or contacting a property expert for clarification.

Verifying comparable sales data independently helps ensure the valuation is fair and based on real, current market conditions. This step confirms that the company’s valuation is accurate and not manipulated, providing a more reliable basis for your decision.

Step 4: Evaluate Company Transparency and Communication

Assess how transparent and communicative the company is throughout the valuation process.

What to Do:

-

Gauge Responsiveness:

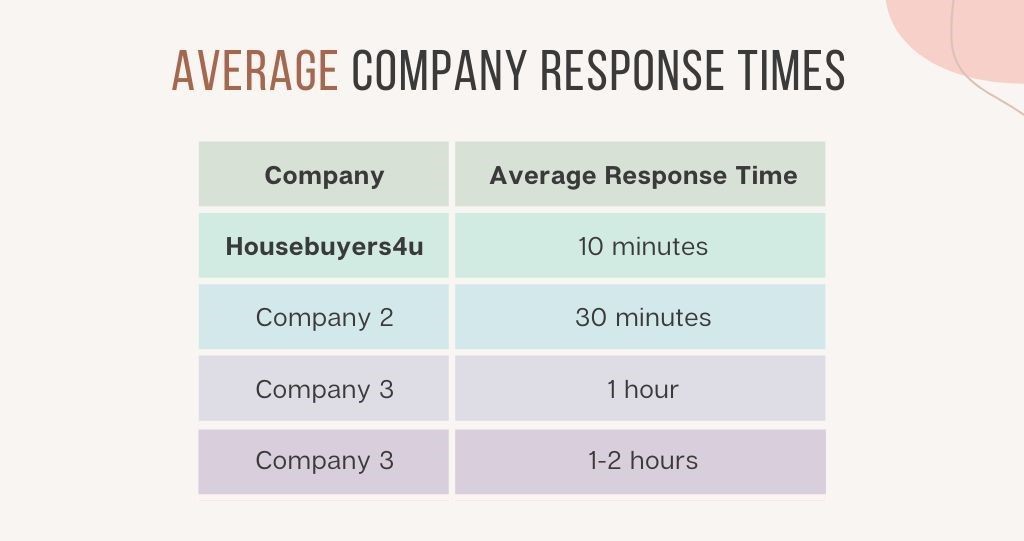

- Monitor how quickly and thoroughly the company responds to your questions and requests for information.

-

Check for Transparency:

- Ensure the company willingly shares detailed information and clearly explains their valuation process.

-

- Be cautious if the company is evasive or reluctant to provide detailed explanations or reports.

In today’s competitive market, fast response times are crucial for customer satisfaction, with 75% of consumers valuing prompt replies highly and 78% buying from the vendor who responds first. Ensuring clear and timely communication during the property valuation process builds trust and transparency.

A transparent and communicative company is more likely to be trustworthy and fair in their valuation process, ensuring you get a fair offer for your property. Good communication and transparency build trust and confidence in the transaction, making the process smoother and more reliable.

Get a Fair, Transparent Offer with Housebuyers4u

At Housebuyers4u, we believe every seller deserves a clear, honest valuation, with no hidden deductions or vague reports. Our process is fully transparent: you receive a detailed written valuation, real sales data to support it, and straightforward answers at every step.

-

No pressure, no guesswork, just a genuine offer you can trust.

-

See exactly how we value your property, with nothing hidden.

-

All your questionswill be answered quickly by our experienced team.

Get your free, no-obligation valuation from us today and see how selling your home should feel.

Learn more about how to check if a Company is Legitimate