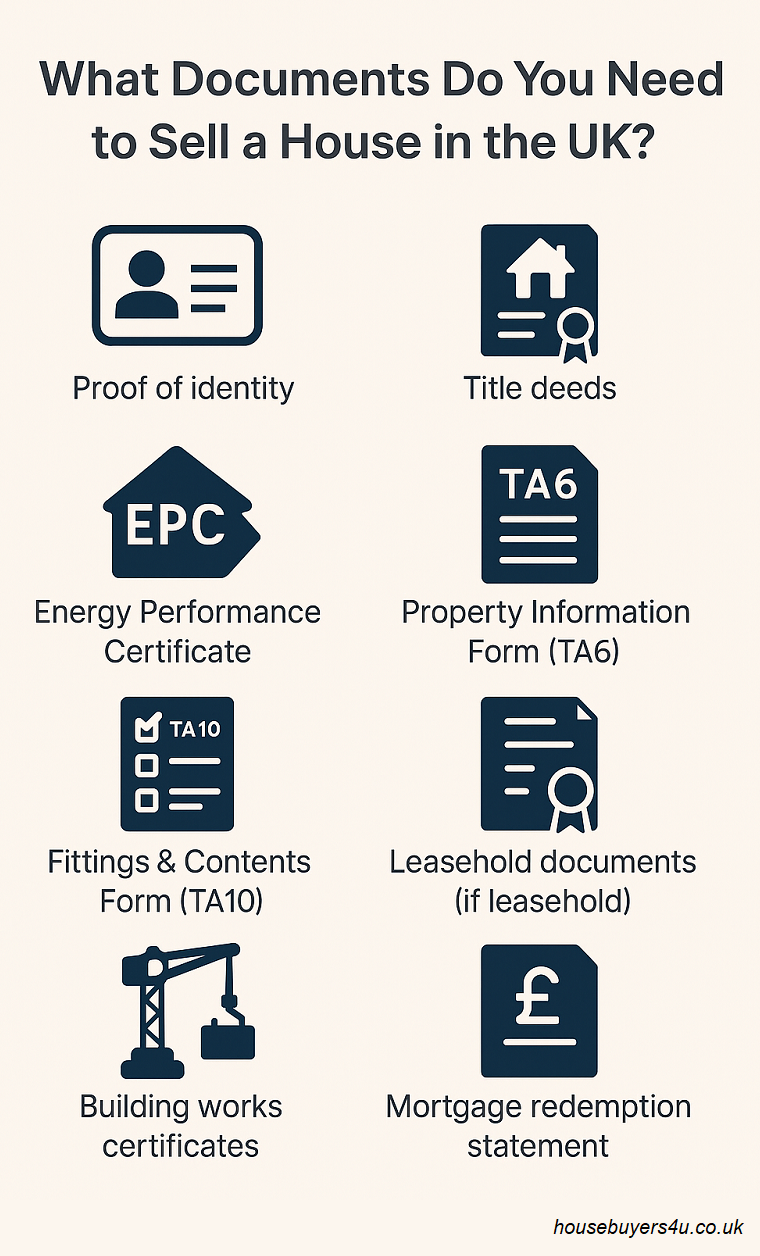

What Paperwork do I Need to Sell my House in the UK?

To sell your house in the UK, you’ll need to provide proof of identity, your property’s title deeds, an up-to-date Energy Performance Certificate (EPC), and completed property information forms (TA6 and TA10). Getting these ready early helps avoid delays and keeps your sale moving.

3 Key Takeaways:

- The main paperwork includes ID, title deeds, EPC, and property forms TA6 & TA10.

- Leaseholds, new builds, or renovated homes may need extra paperwork like leases, warranties, or certificates.

- Get your paperwork ready early to avoid delays and keep buyers keen.

What Documents Do You Need to Sell a House in the UK?

Our expert team has compiled the essential paperwork you need when selling a property in the UK.

- Proof of identity: Needed for anti-money laundering checks, typically a passport or driving licence plus a recent utility bill.

- Title deeds: Proves you own the property. If you can’t find them, your solicitor or Land Registry can help.

- Energy Performance Certificate (EPC): Legally required to show how energy efficient your home is. Valid for 10 years.

- Property Information Form (TA6): Details everything a buyer needs to know about the property boundaries, disputes, works done, and more.

- Fittings & Contents Form (TA10): Lists what is and isn’t included in the sale, like appliances, curtains, and furniture.

- Leasehold documents (if leasehold): The lease agreement and details of ground rent, service charges, and any management pack needed.

- Building works certificates: Includes planning permissions, building regulations approval, FENSA certificates for new windows, and any warranties.

- Mortgage redemption statement (if you have a mortgage): Shows the remaining balance so your solicitor can settle the loan on completion.

Why Each Document Matters

| Document | Why It Matters |

|---|---|

| Title deeds & ID | Proves you own the property and satisfies legal anti-fraud checks. |

| Energy Performance Certificate | Required by law, the energy efficiency of your home is shown to buyers. |

| Property Info Forms (TA6 & TA10) | Outlines property details and what’s included in the sale, avoiding disputes. |

| Leasehold documents (if leasehold) | Needed for flats/leaseholds covers lease terms, charges, and management. |

| Certificates (FENSA, planning, etc.) | Proves legal, safe improvements; missing docs can put off buyers. |

| Mortgage redemption statement (if mortgage) | Lets your solicitor settle your loan so the sale can complete. |

The Real Impact of Missing Documents: Housebuyers4u Insights

Our property team has reviewed internal data and compiled the report below, providing valuable insights into the actual impact of missing paperwork.

| Doc | Why It Matters | Hb4u Insight |

|---|---|---|

| Title deeds & ID | Proves ownership and clears anti-fraud checks. | 70% of transactions that faced delays at HB4u were due to missing ownership or ID documents, having these early keeps sales on track. |

| Building works certificates | Shows legal compliance, missing paperwork here can deter buyers. | In 30% of HB4u cases, delays occurred because sellers needed to track down FENSA, planning, or building reg certificates; having them ready avoids hold-ups. |

Expert insight from Paul Gibbens, Housebuyers4u:

"In my experience, the smoothest house sales always come down to having the right paperwork ready. Even just one missing certificate or an incomplete form can put the brakes on a deal, so I always tell sellers to get organised early. It saves everyone a lot of hassle in the long run."

Quick Solutions for if you have any Missing Paperwork

If you’ve lost or can’t find a key document, don’t panic; there’s usually a fix:

-

Title deeds: Request a copy from HM Land Registry or your solicitor.

-

EPC: Order a new assessment from a local accredited energy assessor.

-

Property forms (TA6/TA10): Download new copies online or ask your solicitor/estate agent to resend them.

-

Certificates (FENSA, planning, etc.): Contact the original contractor or local authority for replacements. If they’re unavailable, consider indemnity insurance.

-

Leasehold documents/management packs: Request fresh copies from your freeholder, managing agent, or solicitor.

-

Mortgage statement: Ask your lender for a redemption statement; most provide these quickly on request.

Obtaining replacement documents early helps prevent last-minute delays and ensures your sale proceeds smoothly.

With around 30% of UK property transactions collapsing before completion, often due to documentation issues or delays, getting replacements early can be the difference between success and a stalled sale.

Ready to Get Your Paperwork Sorted?

Getting all your documents in order early is the easiest way to keep your sale on track and avoid those last-minute headaches.

If you’re unsure what you need or struggling to find certain paperwork, our Housebuyers4u team is here to guide you through the process. Reach out for honest advice, help tracking down missing documents, or just a quick checklist, we’ll make sure you’re fully sale-ready from day one.

Find out how much we can Offer for your House