Secrets of Conveyancing: What Need to Know to Save Time & Money (Guide)

Want to save thousands on your property sale and cut weeks off your conveyancing time? Our insider guide reveals the secrets most experts won't tell you, including:

- The hidden fees that could cost you thousands - and how to avoid them

- A step-by-step timeline to speed up each stage of the conveyancing process

- The secret "pre-contract checklist" used by top conveyancers to prevent delays

- The True Cost of Conveyancing: What Others Don't Tell

- Quick Tricks for Faster Conveyancing

- Dodge the Curveballs: Solving Conveyancing Hiccups

- Choosing the Right Conveyancer: What You Need to Know

- Insider Tricks: Speed Up Your Sale, Keep More Cash

- Conveyancing and Quick Sales: The Perfect Partnership

- Don't Skip the Fine Print: Legal Aspects You Can't Ignore

- Frequently Asked Questions about Conveyancing

What is Conveyancing?

Conveyancing is the legal process of transferring property ownership. It's not just paperwork - it's a crucial step that protects your interests and ensures a smooth transaction. Understanding conveyancing can save you time, money, and stress whether you're buying or selling.

Many don't realise that efficient conveyancing is key to quick property sales. A skilled conveyancer can speed up the process, potentially saving you thousands in mortgage payments or rental costs.

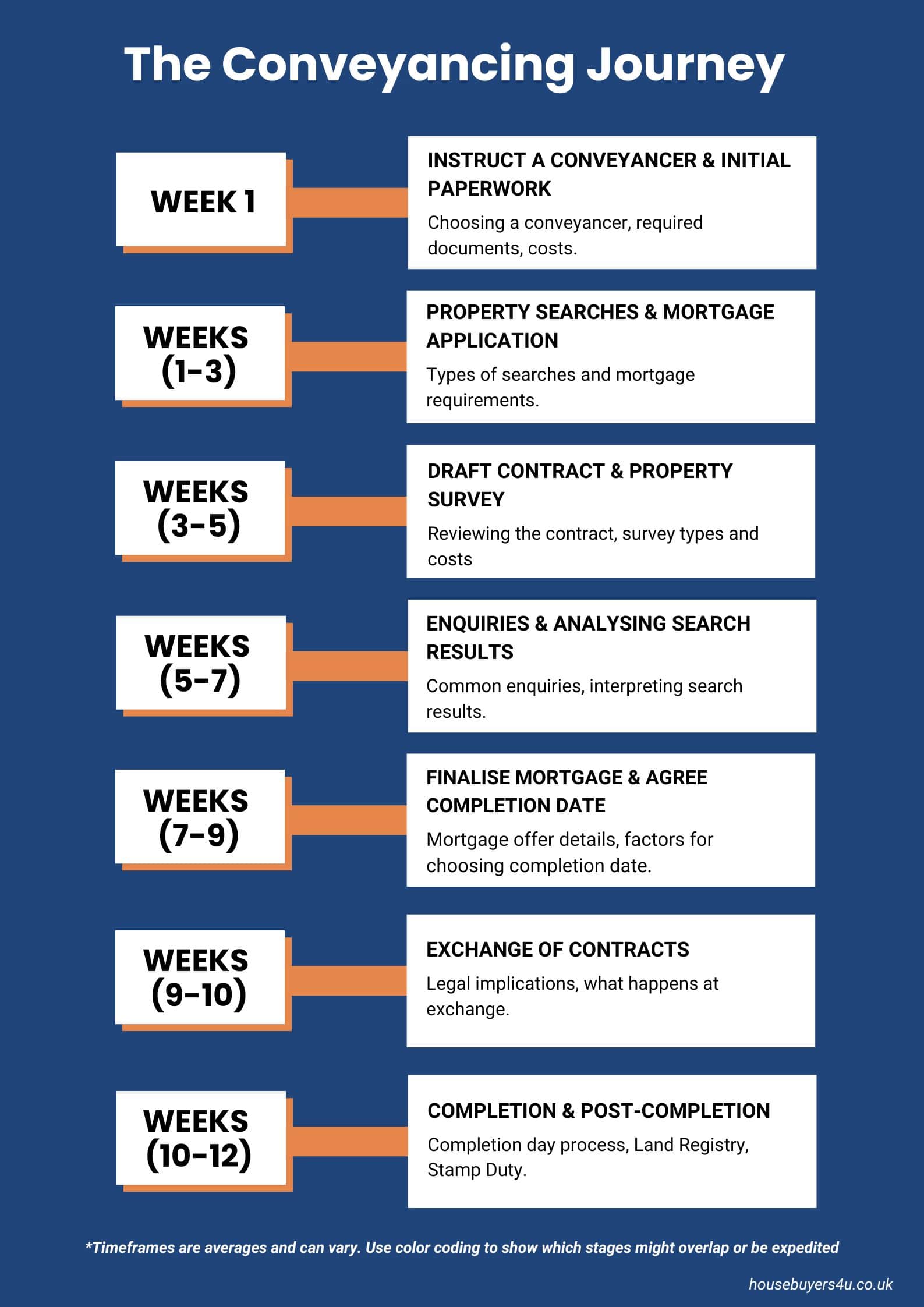

The Conveyancing Journey Revealed

Getting through the conveyancing process can feel like a maze, but knowing the key stages helps you stay on track. It all kicks off when you hire a conveyancer and wraps up when the money and property change hands. Along the way, you'll hit big milestones like property searches, looking over the draft contract, and exchanging contracts.

Don't overlook the property survey. It's not legally required, but it can save you from expensive surprises later. In fact, according to the HOA 1 in 3 homebuyers who had a house survey took action as a result of issues flagged. This shows why investing in a survey can save you money and prevent unforeseen surprises.

Expert Tip:

Pre-Contract Home Checks You Can't Skip

The pre-contract stage is crucial in conveyancing, yet many homeowners underestimate its importance. During this phase, your conveyancer conducts critical legal checks that can make or break your property sale. These include verifying the property's title, checking for any restrictive covenants, and ensuring all necessary planning permissions are in place.

Did you know that nearly 30% of property transactions face delays due to issues uncovered during these initial checks?

Property searches are another vital component of this stage. These investigations uncover essential information about the property and its surroundings. Local authority searches reveal planning permissions and potential road schemes, while environmental searches can flag up contamination risks or flood hazards. Water and drainage searches confirm the property's connection to public systems. These searches matter because they can reveal deal-breaking issues or future costs that might affect your decision to proceed with the sale.

Related: What do surveyors check during a house survey?

Expert Tip

The Big Moment: Exchanging Contracts

Exchanging contracts is when things get real in your home sale. It's not just a handshake deal - it's the point where both sides are legally committed to the sale.

Many people think exchanging contracts is just swapping some paperwork, but there's more to it. Your conveyancing solicitor will read out the contract details over the phone to the other side's conveyancer. Once both agree, the contracts become legally binding. From this point, backing out could cost you your deposit and maybe even more.

Watch out for these common pitfalls:

- Not having your house deposit ready - delays can derail the whole process

- Forgetting to confirm your buildings insurance - you're responsible for the property from exchange

- Miscommunicating the completion date - mix-ups here can be costly

Expert Tip:

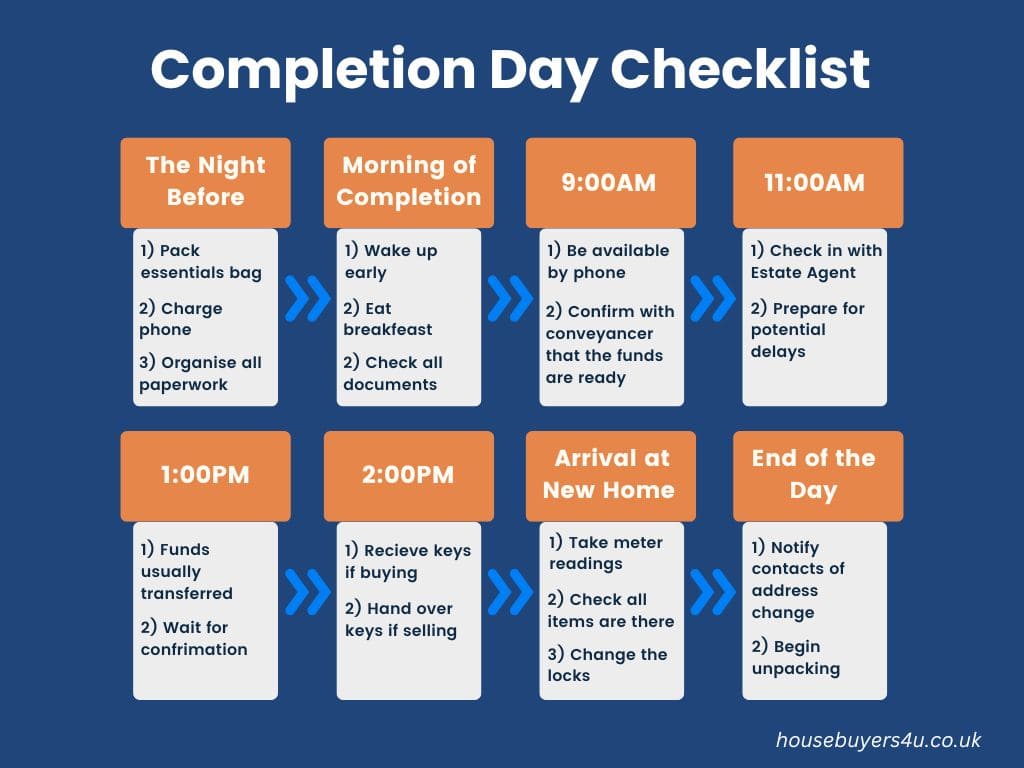

Completion: Sealing the Deal

You're almost there! Completion day is when you finally get the keys to your new place or hand them over to the buyer. It's exciting, but it can also be nerve-wracking if you're not prepared.

Here's how to keep things smooth:

- Have your bags packed and ready to go the night before

- Keep your phone charged and on hand - your conveyancer might need to reach you

- Don't plan anything else for the day - completion can sometimes take longer than expected

Want to speed things up? Try these tactics:

- Schedule completion for early in the week - this gives you wiggle room if there are any hiccups

- Have all your paperwork organised and easily accessible

- Consider using same-day electronic money transfers instead of banker's drafts

Expert Tip:

Once you've got the keys, don't forget to change the locks. It's a simple step that many people overlook, but it ensures you're the only one with access to your new home. Also, take meter readings right away to avoid any disputes with utility companies later on.

Remember, a little preparation goes a long way in making your completion day a celebration rather than a stress-fest!

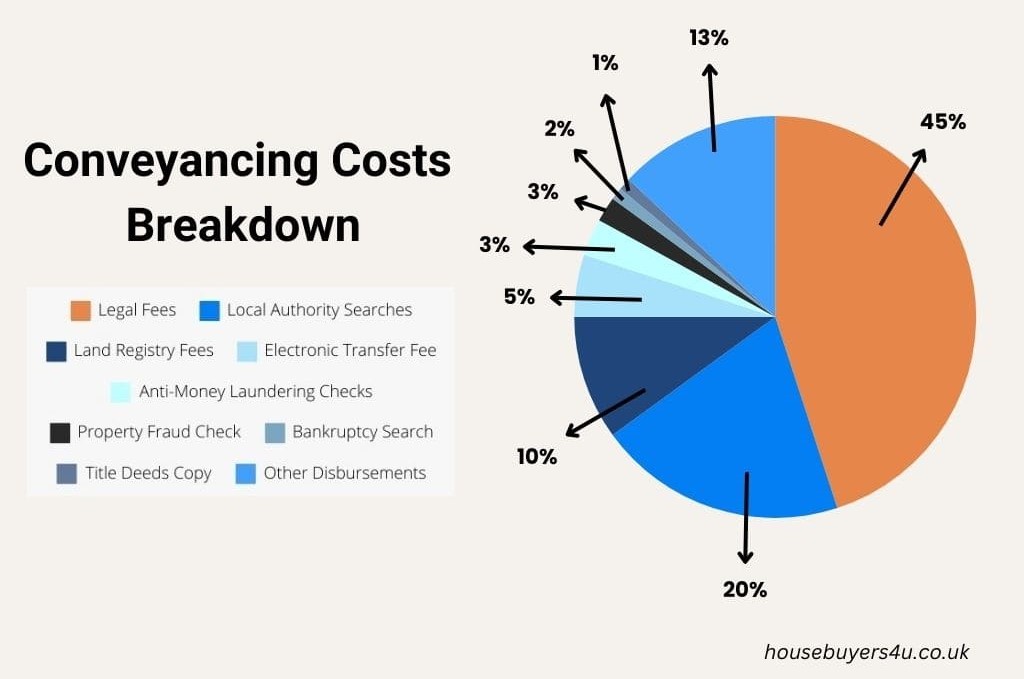

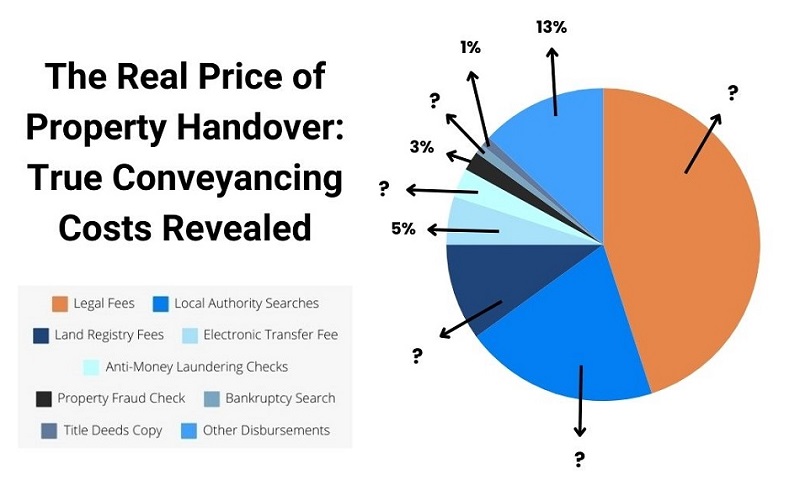

The True Cost of Conveyancing: What Others Don't Tell You

When it comes to conveyancing fees, the costs can add up faster than you might think. Let's pull back the curtain on what you're really paying for:

- Legal fees: This is what your conveyancer charges for their time and expertise

- Search fees: Covering local authority, environmental, and water searches

- Land Registry fees: For registering the property in your name

- Bank transfer fees: For moving large sums of money securely

You can find a more detailed breakdown of fees below:

But here's something many don't know: house buying companies often cover these conveyancing fees. If you're looking for a speedy sale, this could save you anywhere from £800 to £1,500 on average. It's a perk that can make a big difference to your bottom line.

Expert Tip:

Quick Tricks for Faster Conveyancing

Want to zoom through your property sale? Here's how to put your foot on the gas:

First, nail this prep checklist:

- ID (passport or driving license)

- Recent utility bills

- Last 3 months of bank statements

- Property title deeds (if you have them)

- Mortgage details

- Any warranties for home improvements

- Building regulation certificates

- Up-to-date Energy Performance Certificate (EPC)

Having these docs ready can cut weeks off your timeline. It's like showing up to a race with your running shoes already tied!

Must-have papers that often slip through the cracks:

- Fensa certificates for any new windows

- Gas safety certificates

- Electrical installation certificates

- Planning permission documents (if you've done any major work)

Expert Tip:

Tech is your friend here. Ask your conveyance or solicitor if they use online portals like Hoowla or InfoTrack. These let you upload docs, track progress, and chat instantly. It's like having a conveyancing command center right on your phone!

Remember, in this game, the early bird doesn't just catch the worm - it closes the deal faster too. The more prep you do now, the smoother your sale will go later.

Dodge the Curveballs: Solving Conveyancing Hiccups

Even the smoothest sales can hit a snag. Here's how to tackle common issues like a pro:

Problem-Solution Quick Guide:

- Slow searches: Chase your conveyancer weekly and ask if personal searches are an option.

- Chain delays: Keep open communication with all parties and consider a 'no sale, no fee' agreement.

- Survey surprises: Get multiple quotes for any required work to negotiate fairly.

- Mortgage hiccups: Have a backup lender in mind and all paperwork ready to go.

When delays pop up (and they might), keep cool and communicate. Be the squeaky wheel - politely chase your conveyancer and estate agent regularly. If disputes arise, stick to the facts and always get agreements in writing.

Expert Tip:

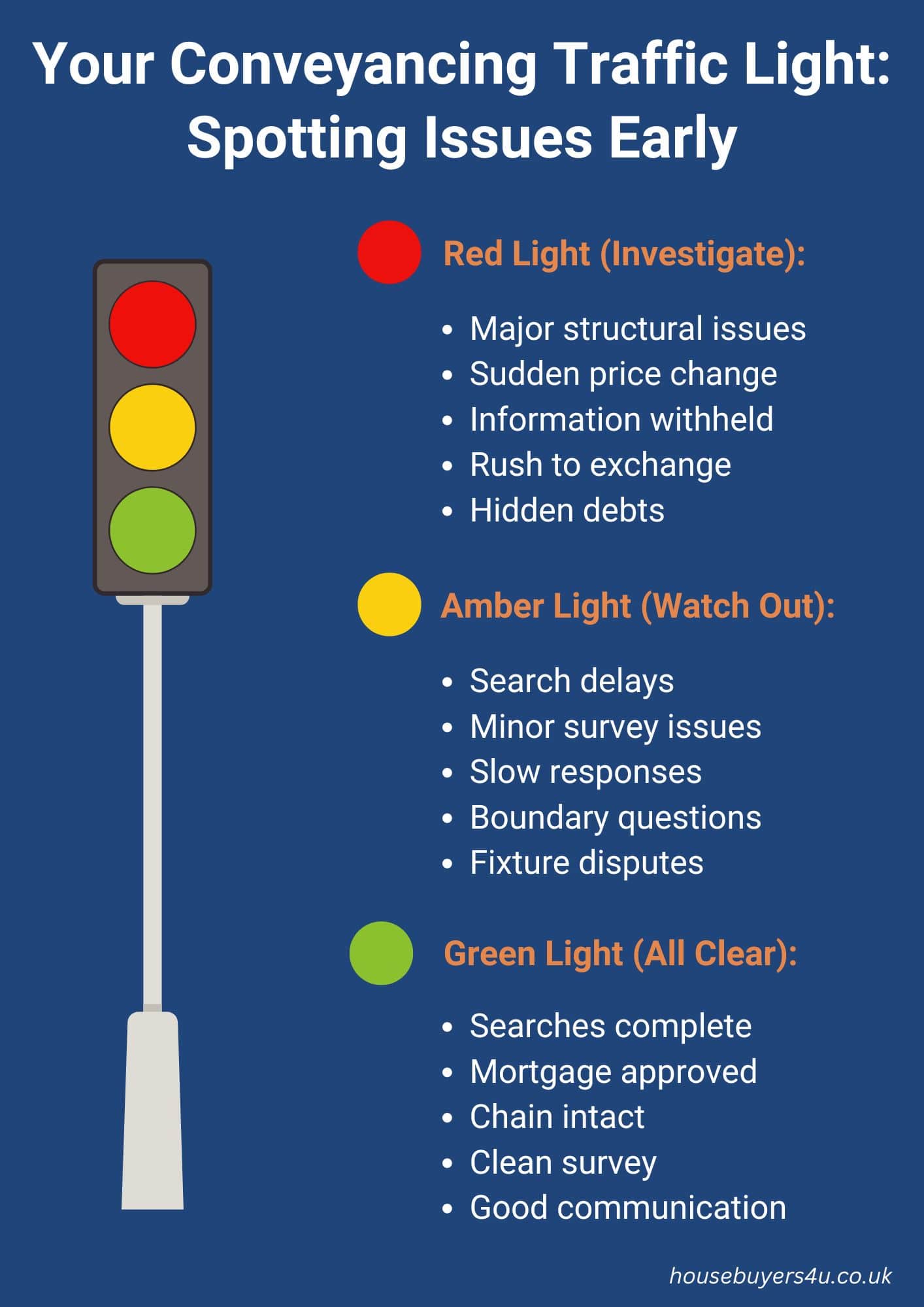

Watch out for these red flags:

- Seller reluctant to provide information

- Unusual restrictions in the property title

- Sudden rush to exchange without explanation

- Unexplained last-minute price changes

Any of these could signal bigger issues. If you spot one, pause and dig deeper. It's better to slow down now than face bigger problems later.

Remember, most hiccups in conveyancing can be sorted with a bit of know-how and a cool head. Stay informed, stay calm, and you'll be signing those final papers before you know it.

Choosing the Right Conveyancer: What You Need to Know

Finding the right conveyancer can make or break your property deal. They're not just paperwork pushers – a good conveyancer is your legal shield and deal navigator. With the average UK property transaction taking 20-25 weeks (according to Zoopla), choosing wisely can shave weeks off this timeline and potentially save you thousands.

Top 5 must-have traits:

- Clear communicator

- Proactive problem-solver

- Tech-savvy

- Experienced in your property type

- Transparent about fees

Questions that separate the best from the rest:

- "How often will you update me?"

- "What's your average completion time?"

- "How do you handle unexpected issues?"

- "Do you offer a 'no sale, no fee' guarantee?"

- "What's your process for handling urgent queries?"

Online vs. Traditional Conveyancers:

| Factor | Online Conveyancers | Traditional Conveyancers |

|---|---|---|

| Cost | Often cheaper | Usually more expensive |

| Accessibility | 24/7 access | Limited office hours |

| Communication | Email/phone/chat | Face-to-face meetings available |

| Local Knowledge | May be limited | Often extensive |

| Technology | Typically more advanced | May be less tech-focused |

| Personal Touch | Can be less personal | Often more personalised service |

| Speed | Can be faster | May be slower |

| Document Handling | Mostly digital | A mix of digital and physical |

DIY vs. Professional Conveyancers:

Are you thinking about handling your own conveyancing? It's a big decision that could save you money - or cost you dearly.

Here's a quick comparison:

| Factor | DIY Conveyancing | Professional Conveyancing |

|---|---|---|

| Cost | Generally cheaper | Additional professional fees |

| Time Investment | Very high | Relatively low |

| Legal Expertise | Limited (unless qualified) | High |

| Risk Level | Higher | Lower |

| Control | Total control | Less direct control |

| Speed | Often slower | Usually faster |

| Stress Level | Potentially high | Generally lower |

| Support | Limited | Full professional support |

| Errors & Omissions Insurance | Not covered | Typically included |

Expert Tip:

Insider Tricks: Speed Up Your Sale, Keep More Cash

Our team's been in the trenches of quick sales for years. Here's what we've learned about making conveyancing fly:

- Front-load the work: Get all your paperwork ready before you even list your property. This alone can cut weeks off your timeline.

- Communication is key: Set up a WhatsApp group with your estate agent and conveyancer. Quick questions get quick answers.

- Be proactive, not reactive: Chase for updates weekly. Don't wait for others to move things along.

Read Mrs Thompsons story on how she saved £1800 in fees.

Expert Quote from Paul, our Property Expert:

"In fast-paced sales, conveyancing can make or break the deal. We've found that pairing an experienced conveyancer with our quick sale process can cut the average transaction time by 40%. It's all about anticipating issues before they arise and having solutions ready to go."

Remember, speed doesn't mean cutting corners. It's about smart preparation and staying one step ahead throughout the process.

Expert Tip:

Conveyancing and Quick Sales: The Perfect Partnership

When speed is of the essence, quick sales and efficient conveyancing go hand in hand. Here's why they're a match made in property heaven:

Quick sales strip away the complexity:

- No property chains to worry about

- Fast house buyers mean no mortgage delays

- Fewer parties involved speeds up communication

Dodging common pitfalls:

- Reduced risk of gazundering (last-minute price drops)

- Less chance of buyers pulling out

- Minimised impact of market fluctuations

Expert Tip:

Remember, while quick cash sales accelerate the process, they don't cut corners on legal necessities. You're just removing the waiting and uncertainty that often bog down traditional sales.

Pro Move: If you're using a quick sale company, ask if they have preferred conveyancers. These partnerships often result in even speedier transactions as they're used to working together efficiently.

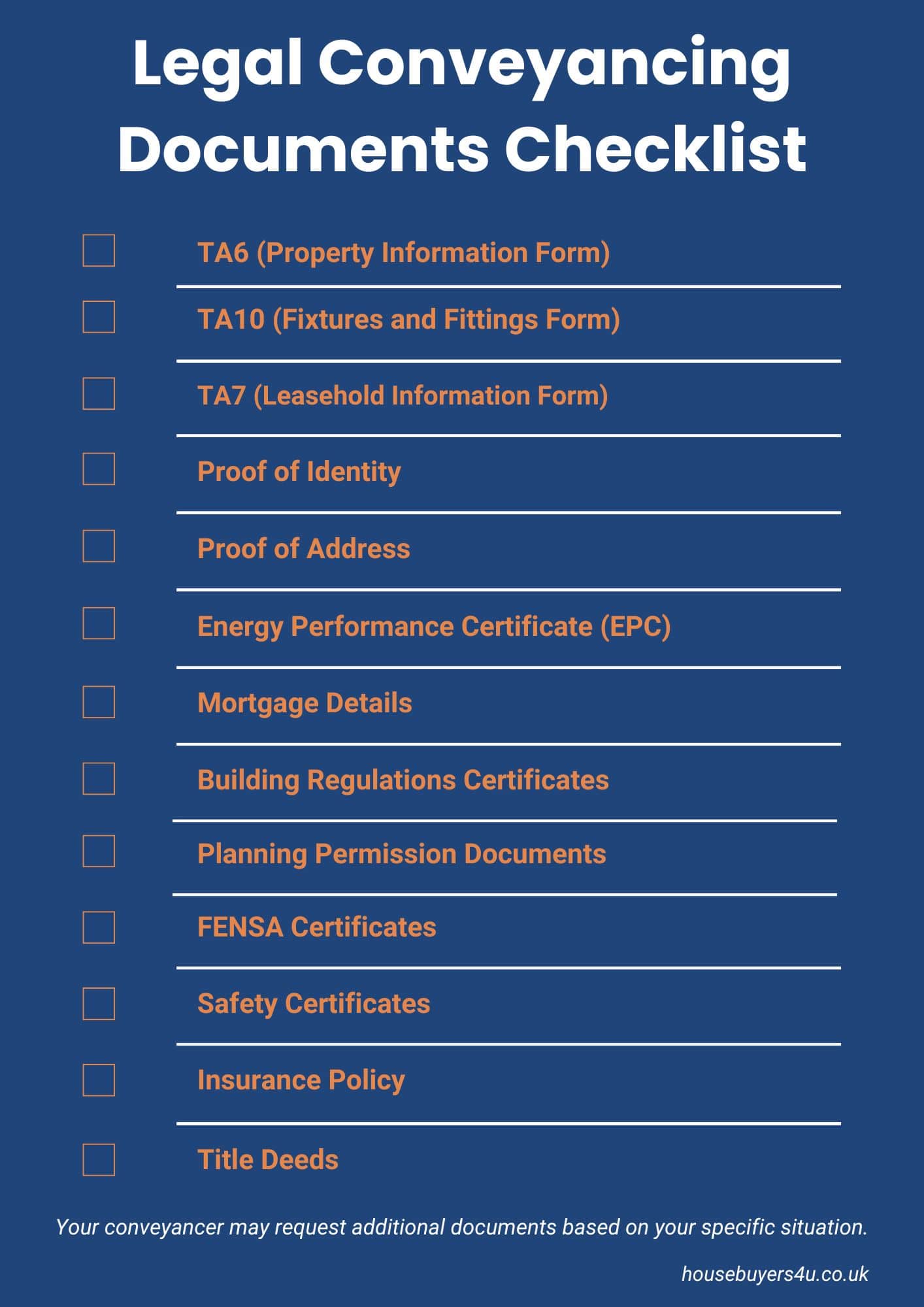

Don't Skip the Fine Print: Legal Aspects You Can't Ignore

Even in a quick sale, some legal steps are non-negotiable. These are the backbone of a secure property transfer, protecting both buyer and seller. Understanding these essentials can help you navigate the process more smoothly and avoid costly delays. Let's break down what you need to know and which legal documents you will need:

Click here to download the legal documents checklist

Common legal hiccups and quick fixes:

- Title issues: Get your hands on the title deeds ASAP

- Boundary disputes: Old photos can be your best friend here

- Planning permission problems: Dig out those old approval letters

Expert Tip:

Remember, cutting corners on legal aspects can backfire. The goal is to be thorough and efficient.