How to Stop Repossession of Your House (What You Can Do Now)

If you’ve fallen behind on mortgage payments and are worried about losing your home, you’re not alone and it’s not too late. In most cases, repossession can be delayed or stopped entirely, but it’s critical to act quickly. We explain what steps you can take right now, what your rights are, and the long-term options available to prevent repossession in the UK.

Key Takeaways:

- You can stop repossession at almost any stage, but the earlier you act, the more options you’ll have.

- Lenders must follow strict legal steps before they can take your home.

- You may be able to stop repossession by setting up a repayment plan, applying to court, or selling the property yourself.

What Is a House Repossession?

House repossession is when your mortgage lender takes legal action to reclaim your property due to missed payments. If you fall behind and can’t agree on a solution, the lender can go to court, get a possession order, and eventually evict you. It’s a last resort, but if no repayment plan is in place, they have the right to sell your home to recover what you owe.

Can You Stop a House Repossession?

Yes, in most cases, you can stop house repossession, even if court proceedings have already started. Many homeowners successfully delay or prevent repossession by taking action early, negotiating with their lender, or applying to the court. The key is acting quickly. The sooner you respond, the more control you have over the outcome, whether that’s setting up a repayment plan, selling the property, or applying to suspend the eviction.

Immediate Steps to Stop House Repossession in the UK

If you’ve missed payments and received a warning from your lender, it’s crucial to act fast. Repossession doesn’t happen overnight, and in most cases, you still have time to stop it.

1. Contact Your Lender Immediately

Don’t ignore letters or calls. Most lenders prefer to recover missed payments through an agreement rather than going to court.

Ask if they’ll accept:

-

A repayment plan based on what you can afford

-

A short-term payment holiday (if your situation is temporary)

-

A switch to interest-only payments to reduce costs temporarily

2. Apply to the Court to Suspend Possession

If court action has already started, you can still apply to suspend or delay the repossession order. This is done using an N244 court form and is more likely to succeed if you:

-

Show a realistic plan to clear arrears

-

Provide proof of income or benefits

-

Demonstrate you're actively trying to sell the home

3. Get Help from a Free Debt Advice Service

Organisations like StepChange, National Debtline, and Citizens Advice can help you:

-

Create a budget and repayment proposal

-

Speak to your lender on your behalf

-

Fill out court paperwork and avoid legal mistakes

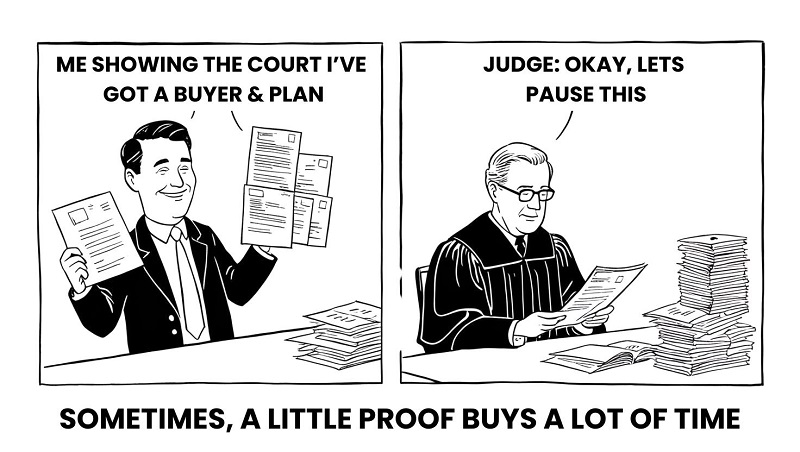

4. Show You’re Taking Action

Whether you're arranging a sale or seeking financial support, provide written proof. This can help your case in court or when negotiating with the lender:

-

A letter from an estate agent or buyer

-

Evidence of benefits or job income

-

A copy of a mortgage support application

The earlier you take these steps, the better your chances of avoiding repossession and maintaining control.

Related Read: Conveyancing guide for properties

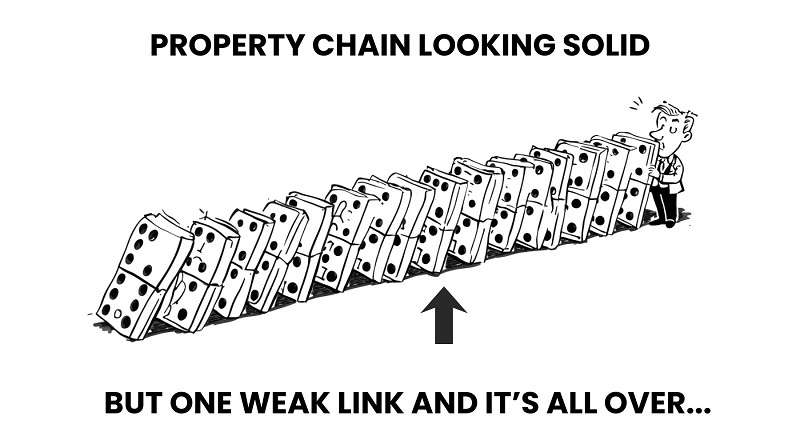

Selling Your House to Avoid Repossession

If you’re unable to catch up on mortgage payments, selling your house quickly can be one of the most effective ways to stop repossession, especially if you act before the court process progresses too far.

Why Selling Works

A fast sale gives you the funds to:

-

Clear your arrears

-

Settle the mortgage

-

Avoid a repossession order being granted

Once the debt is cleared, the repossession process stops, and you stay in control of the sale rather than having it forced by a lender.

Key Benefits:

-

Avoids court and legal fees

-

Protects your credit record from a repossession mark

-

Gives you more flexibility, including time to find your next home

Repossession rates in the UK have dropped significantly in recent years from around 48,900 in 2009 to just 8,000 by 2019, according to UK Finance. This decline is largely due to the Mortgage Pre-Action Protocol, which encourages lenders to work with homeowners and explore alternatives, such as voluntary sale, before pursuing court action. It’s a clear sign that acting early and showing a willingness to resolve the debt can lead to better outcomes.

Expert advice from our property expert Paul Gibbens:

"In my experience, selling the property before repossession takes hold is one of the most effective ways to stay in control. I’ve helped countless homeowners who were just weeks away from losing everything but by acting early, they avoided court, cleared their mortgage, and even walked away with cash in hand. If you're falling behind, don’t wait for the lender to act.

Taking the first step yourself puts you in a much stronger position."

What If It’s Already with the Court?

Even if your repossession case has gone to court, you still have options but you’ll need to act fast.

Apply to Suspend the Eviction

If a possession order has been granted but the eviction hasn’t happened yet, you can apply to the court to suspend or delay the eviction. This is done using a form called N244, and it must be submitted before the bailiffs arrive.

What the Court Will Consider

The court may agree to suspend the eviction if you can show:

-

A realistic repayment plan to clear the arrears over time

-

Proof that you’re selling the property to repay the mortgage

-

A change in circumstances, such as new income or benefits

Even if an eviction date has been set, there’s often still a small window to intervene, especially if you show you’re making genuine efforts to resolve the debt.