Part Exchange House Explained (Is it Worth it in 2025?)

Part exchange means using your current house as part-payment for your next property, usually a new build. The developer buys your home directly, helping you skip the open market and move faster, but it often comes at a lower price than selling traditionally.

Key Takeaways:

- Part exchange skips the open market with the developer buying your home.

- You get speed and convenience, but usually below market value.

- Not every property qualifies — this guide covers the key rules and risks.

-

- What Does Part Exchange Mean When Buying a House?

- How Does Part Exchange Work on a House?

- Can I Part Exchange My House?

- Can I Part Exchange My House for a Cheaper One?

- Part Exchange House: Pros and Cons

- Are Part Exchange House Calculators Accurate?

- Want a Faster Alternative to Part Exchange?

- Frequently Asked Questions

What Does Part Exchange Mean When Buying a House?

Part exchange means the developer buys your existing home, and its value is deducted from the price of your new property. It’s common with new builds and helps you move faster without listing your house on the open market. You’ll avoid estate agent fees and chains, but you’re likely to accept less than full market value.

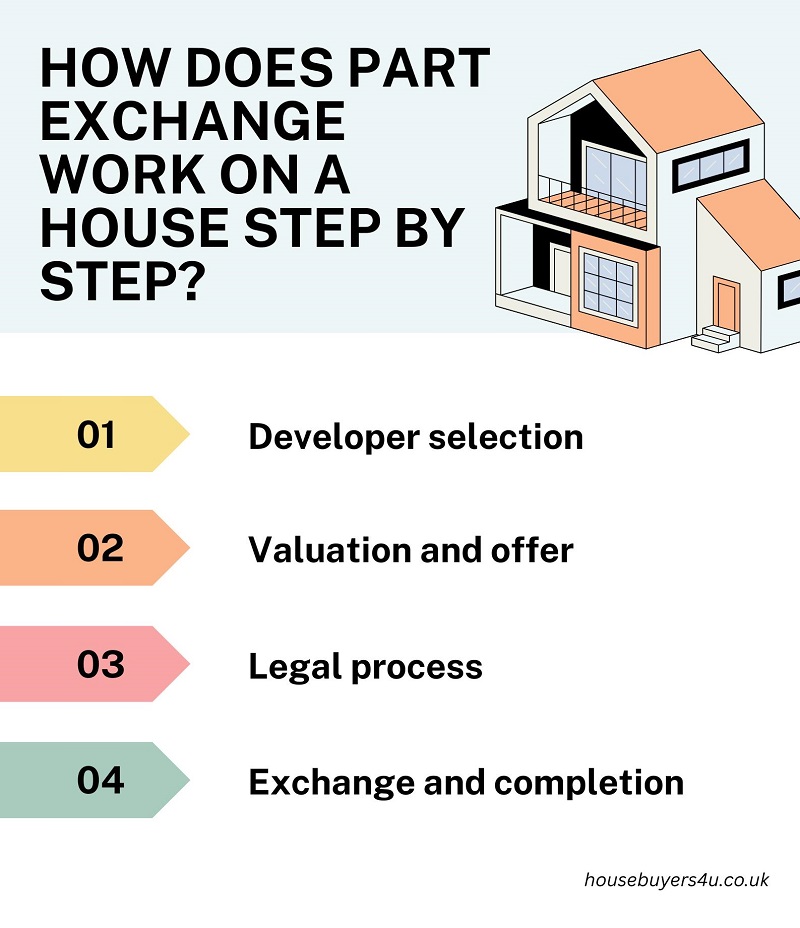

How Does Part Exchange Work on a House?

Part exchange is a simple process where the developer acts as your buyer, making your move quicker and less stressful. Here’s how it works from start to finish.

Step-by-Step Guide

- Developer Selection: Find a developer offering part exchange on the property you want to buy.

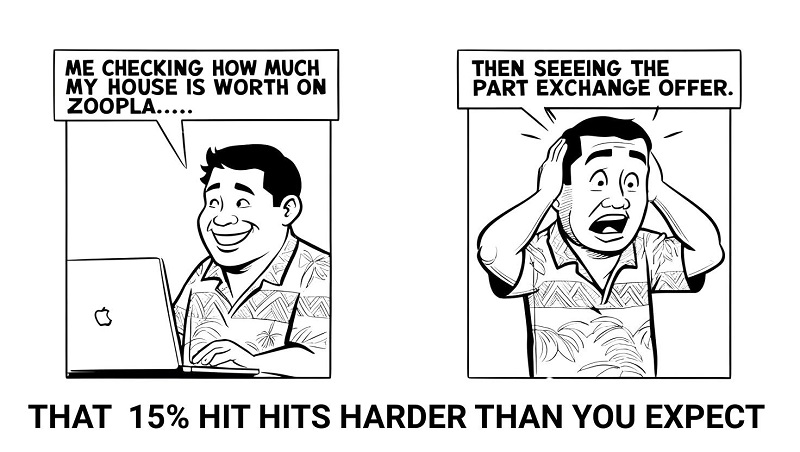

- Valuation and Offer: The developer arranges independent valuations and makes you an offer, typically at a price below market value.

- Legal Process: If you accept, solicitors handle contracts and checks while you arrange your mortgage.

- Exchange and Completion Day: You pay a reservation fee, exchange contracts, and complete the sale, usually within weeks.

What Happens to Your Old House?

Once you complete the process, the developer will resell your old home on the open market. You stay in your current property until your new one is ready, so there’s no need for temporary moves or short-term rentals.

Related Read: How old is my house?

Can I Part Exchange My House?

You can part exchange your house if it meets the developer’s criteria, which usually means your home is in good condition, of standard construction, and valued at around 65–75% of the new property’s price. Leasehold properties typically need at least 80 years left on the lease, and unusual builds or homes in less desirable locations might be excluded, as developers prioritise homes that are easy to resell.

Expert advice from our property expert Paul Gibbens:

"From my experience, developers are selective about the properties they accept for part exchange. They’re looking for homes that they can resell quickly and with minimal investment. If your property is unusual, has a short lease, or needs major work, you’ll likely struggle to qualify.

That’s why it’s crucial to check the developer’s criteria early — it saves you time and avoids disappointment later in the process."

Can I Part Exchange My House for a Cheaper One?

Most developers won’t allow you to part exchange for a cheaper property, as they expect you to move up the ladder with your old home worth less than the new build. However, independent providers offer more flexibility, and some may accept part exchange in downsizing scenarios — though expect a lower offer and limited availability compared to upsizing options.

Part Exchange House: Pros and Cons

Pros

-

Guaranteed buyer

With part exchange, the developer becomes your buyer, so you skip the uncertainty of the open market. You avoid falling through at the last minute and remove the stress of waiting for offers. -

Faster process

Without estate agent delays or lengthy chains, part exchange moves quicker than traditional sales. Once valuations and checks are done, you can typically exchange and complete in weeks rather than months. -

No estate agent fees

Since the sale goes directly to the developer, you won’t pay estate agent commissions, saving you thousands compared to selling on the open market. -

Chain-free sale

Part exchange removes the risk of property chains collapsing. This gives you more control over timings and reduces the risk of last-minute disruptions.

Cons

-

Lower offer than market value

Developers often offer around 80–85% of your home’s open market value. In fact, research from HomeOwners Alliance shows part exchange offers typically sit 10–15% below full market value, depending on property type and location. -

Limited negotiation

Developers have little incentive to negotiate on the new build price or add extras like fixtures and fittings when you’re using part exchange. Expect firm pricing. -

Eligibility restrictions

Not all properties qualify. Your home usually needs to be worth around 65–75% of the new build, be in good condition, and meet specific criteria like lease length and construction type. -

Resale value of new builds

New builds can drop in value once you move in, especially if the developer is still building and selling similar homes nearby. This can impact your future resale potential.

Part Exchange Return Rates in the UK

| Transaction Type | Typical Offer (% of Market Value) | Estimated Discount |

|---|---|---|

| New Build Developer Scheme | 80–90% | 10–20% |

| Independent PX Provider | 80–85% | 15–20% |

Source: Zoopla

This table highlights that homeowners opting for part exchange typically receive offers between 80% and 90% of their property's market value, resulting in an estimated discount of 10% to 20% of the property's value. These figures are consistent across both new-build developer schemes and independent part-exchange providers.

While part-exchange offers the advantages of a quicker sale and reduced hassle, it's essential to weigh these benefits against the potential financial trade-off. For those prioritising speed and convenience over maximising sale price, part exchange can be a viable option.

Are Part Exchange House Calculators Accurate?

Most part exchange house calculators give only a rough estimate by applying a standard discount to your property’s market value, usually between 80% and 85%. These tools can be useful for a quick ballpark figure, but they’re based on generalised data and often miss important factors like property condition, location desirability, or local market shifts. Calculators also won’t account for developer-specific criteria or incentives, which can affect the final offer.

Related Read: What is the true value of my property?

See How our Cash Offer Compares to Part Exchange