What Do Surveyors Check When Valuing Houses? (Tricks Revealed)

Updated: July 2025

When valuing a house, surveyors inspect the property’s structure, condition, and key features such as the roof, walls, and drainage, looking for any defects or risks. They also consider the home’s size, location, and recent local sales to calculate a fair market value.

Key Takeaways:

- Spot major issues early, surveyors look for damp, cracks, subsidence, and hidden damage.

- The right survey level can save thousands by uncovering problems before you buy or sell.

- Surveyors factor in local market trends, property age, and potential for future works.

What do Surveyors Look for When Valuing a Property?

Did you know, 70% of homebuyers regret skipping a property survey, a crucial step in assessing how much your house is worth.

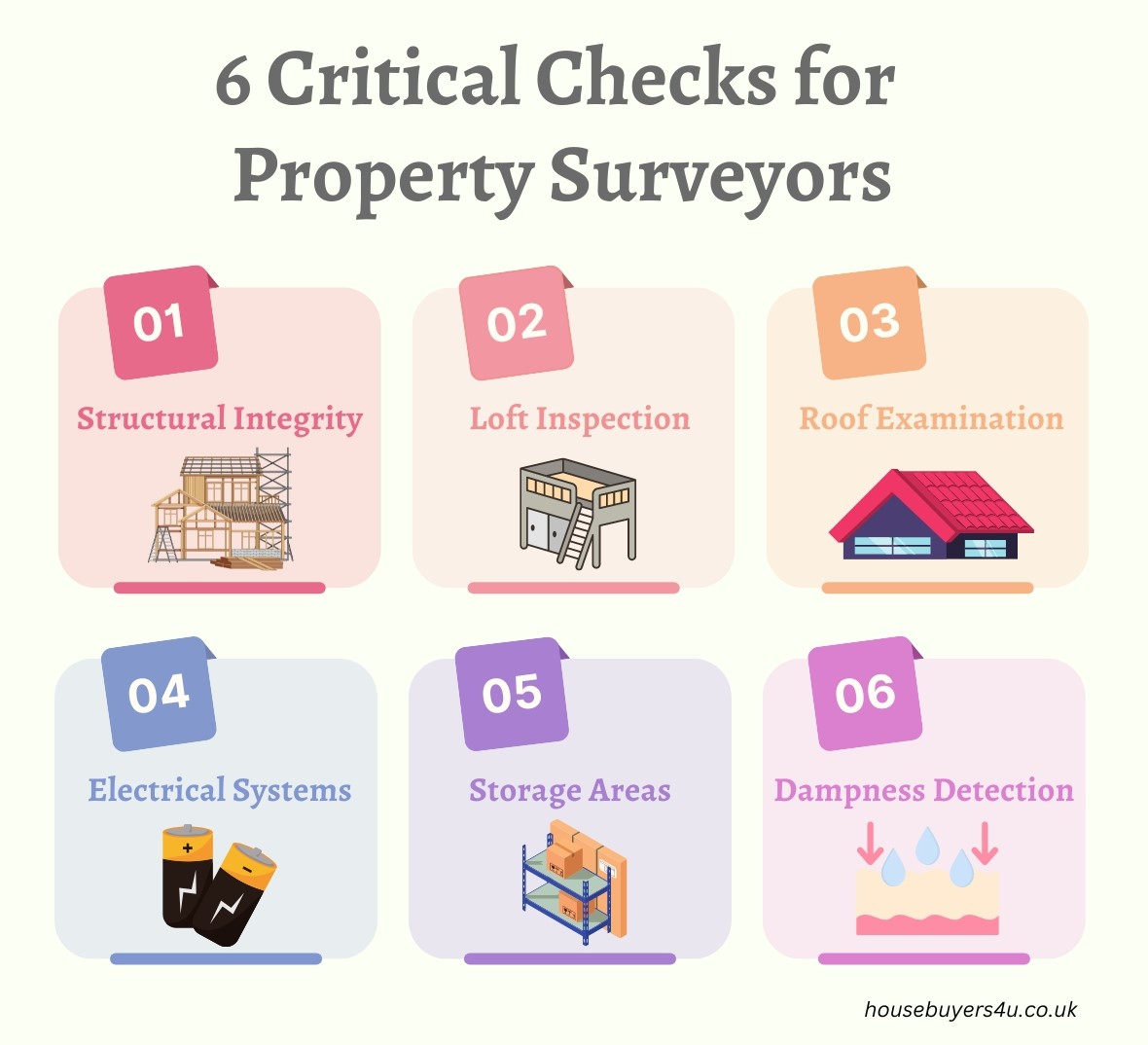

Surveyors carry out a detailed inspection to spot costly problems and assess a property’s true condition. Here are the six critical checks every surveyor covers:

-

Structural Integrity – Checks for cracks, movement, and major defects in the building’s framework.

-

Loft Inspection – Looks for issues like rot, leaks, and poor insulation in the loft or attic space.

-

Roof Examination – Assesses the state of roof tiles, flashing, and gutters for signs of wear or damage.

-

Electrical Systems – Reviews the condition of visible wiring, sockets, and the consumer unit for safety concerns.

-

Storage Areas – Inspects cupboards, under-stair spaces, and cellars for damp or hidden problems.

-

Dampness Detection – Tests walls, ceilings, and floors for rising damp, condensation, or mould.

Surveyors will also often check:

-

Plumbing and Heating – Basic visual checks for leaks, old boilers, and heating systems.

-

External Areas and Grounds – Examines fences, boundary walls, paths, and outbuildings.

-

Legal and Environmental Risks – Notes signs of subsidence, Japanese knotweed, or any legal planning concerns.

These checks help you avoid surprises, negotiate repairs, and protect your investment.

Expert insight from our property expert Paul:

“In my years working with sellers and buyers, I’ve seen how much stress and money a good survey can save. When I visit a property, I look at it through your eyes. I want you to know exactly what you’re getting, no nasty surprises. We’re here to make sure you get a fair deal, and I’d always recommend a proper survey to anyone looking to buy or sell.”

Real Data from Housebuyers4u: What Our Surveys Reveal

Wondering what issues actually turn up in the real world? At Housebuyers4u, we track the most common problems uncovered by our RICS-qualified surveyors during valuations. Here’s what our data shows from the last 100 properties we assessed:

| Issue Found by Surveyor | % of Properties Affected | Average Impact on Offer (£) |

|---|---|---|

| Damp or Mould | 38% | -£4,200 |

| Roof Repairs Needed | 29% | -£3,100 |

| Electrical Issues | 19% | -£1,700 |

| Structural Cracks | 14% | -£5,800 |

| Old Boiler/Heating System | 23% | -£2,000 |

| Asbestos Presence | 6% | -£2,900 |

| Japanese Knotweed | 2% | Case-by-case |

What does this mean for you?

Getting a professional survey doesn’t just protect your investment; it gives you a realistic view of your property’s value and the confidence to negotiate. Our experience shows that hidden issues are more common than most sellers expect, but when you know what you’re dealing with, you can plan and sell with confidence.

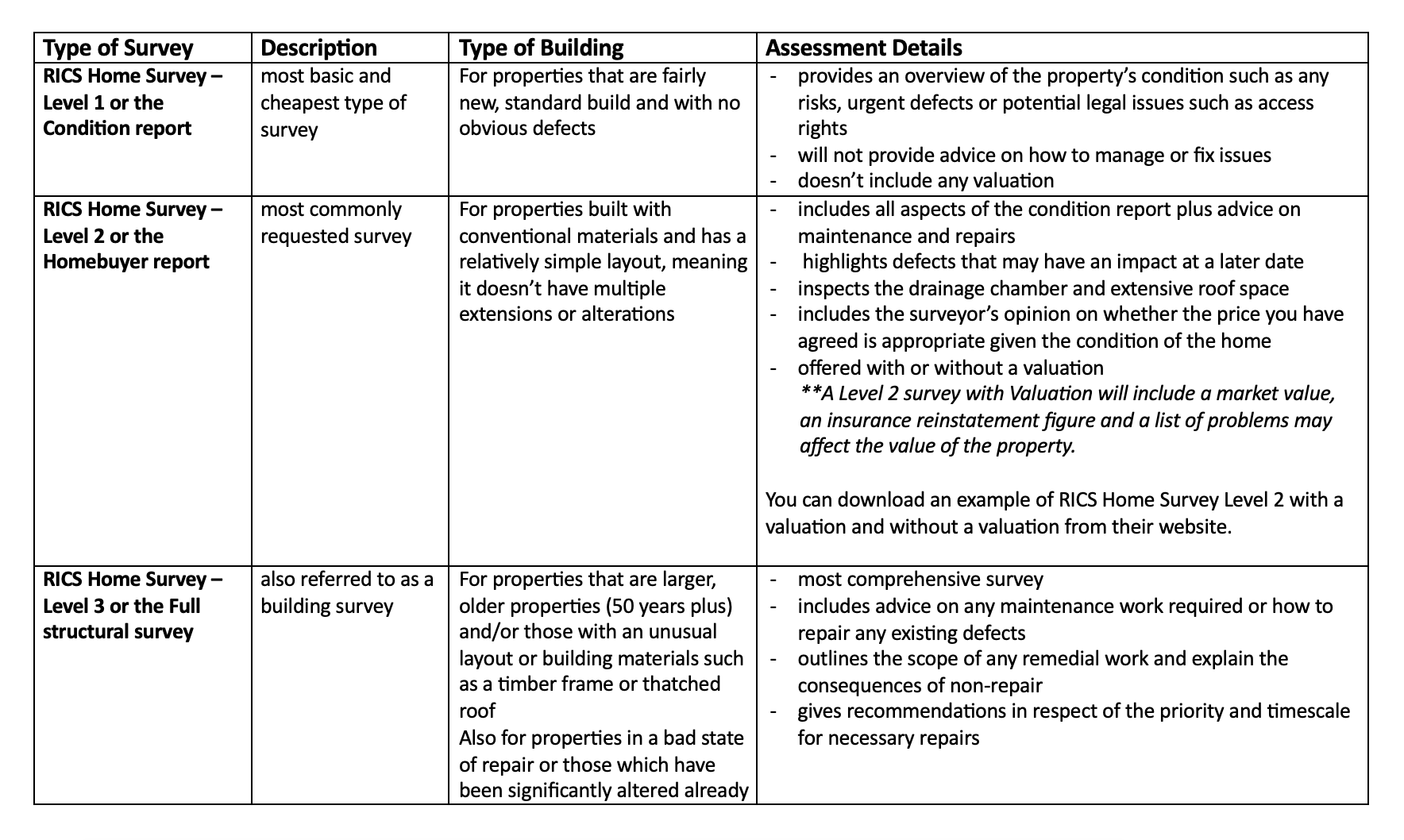

Different Types of House Surveys

The details you’ll receive in your report depend on the type of survey you choose. The more detail you want in your survey, the higher the survey level, and the more you’ll need to pay.

The Royal Institution of Chartered Surveyors (RICS) provided new formats for home survey reports last March 2021. Here are the different types of RICS home survey level available in 2024.

According to data, 61% of buyers chose the RICS Home Survey Level 2, while 33% opted for the same survey with a valuation included, and only 6% selected the more detailed RICS Home Survey Level 3..

The data suggests that most buyers prefer a mid-level inspection possibly due to confidence in the property’s general condition or the cost and time involved.

Homebuyers choosing a RICS Home Survey Level 2 or Level 2 with Valuation saw an average property price of £283,000, with survey costs averaging £403 and £439, respectively. Meanwhile, those opting for the RICS Home Survey Level 3 faced an average property price of £407,000 and a survey fee of £854.

Matthew Cumber, Managing Director at Countrywide Surveying Services, commented:

“The fact that fewer than one in ten property purchases had a Level 2 Survey or above in Q1 2024 presents a highly alarming statistic. It is a figure which leaves a huge number of buyers open to immediate or future risks, unforeseen costs, disruption and upset on what remains one of the most complex and emotive financial journeys they are ever likely to embark upon.

“Due to a sustained lack of awareness, a survey can often be viewed as an additional cost rather than an integral one. The thing homebuyers need to bear in mind is that opting for the right survey could actually save them time, money, and heartache. The cost can often be a fraction of the potential expense from work which needs to be completed on the property which was not identified before contracts are signed.

House Valuation vs. Mortgage Valuation

Understanding the difference between a house valuation and a mortgage valuation helps both buyers and lenders in their financial decisions.

| House Valuation | Mortgage Valuation |

|---|---|

| Conducted by a surveyor | More focused and limited in scope |

| Aims to determine the property's market value | Assures the lender that the property is a suitable security for the loan amount |

| Based on various factors, including its condition, location, and current market trends | Less concerned with the finer details of the property's condition |

| Benefits the buyer | More concerned with its overall worth as collateral |

| Assesses potential risks and renovations | |

| Identifies any unique features that might affect its value |

You can now copy this polished table into your document or editor. Let me know if further refinements are needed!

Related read: How to sell your home for market value after a survey

Get a Fair Cash Offer Backed by a Professional Survey

When it comes to selling your house, knowing exactly what a surveyor checks gives you the edge and peace of mind. At Housebuyers4u, every offer we make is based on a thorough, professional survey by a RICS-qualified expert. That means no hidden issues, no last-minute surprises, and a fair, transparent price.

Ready for a straightforward sale? Get your free, no-obligation survey-backed quote from Housebuyers4u today and take the guesswork out of selling your home.