How to Choose a Conveyancer: Save Time, Money & Stress

Updated: December 2025

Choosing the right conveyancer isn’t just about price; it’s about finding a trustworthy expert who keeps you informed, protects your interests, and ensures your sale or purchase is completed smoothly without unnecessary hassle. Look for strong credentials, clear fees, and good communication from the start.

- Always check your conveyancer’s credentials and regulatory status before you hire.

- Compare quotes carefully, cheapest isn’t always best, and watch for hidden fees.

- Prioritise professionals who are responsive, experienced, and willing to explain things in plain English.

Key Questions to Ask Before Hiring

-

Are you fully licensed and regulated? Ensures your conveyancer is qualified and covered by the right protections.

-

Can you give me a full breakdown of your fees, including any extras? Helps you avoid hidden costs or unexpected charges.

-

How will you keep me updated throughout the process? Effective communication is crucial for a smooth and stress-free experience.

Expert comment from our property expert Paul Gibbens:

"Never be shy about asking these questions up front. In my experience, a reputable conveyancer will answer them clearly and confidently, and if they hesitate or dodge the details, that’s usually a warning sign to look elsewhere.”

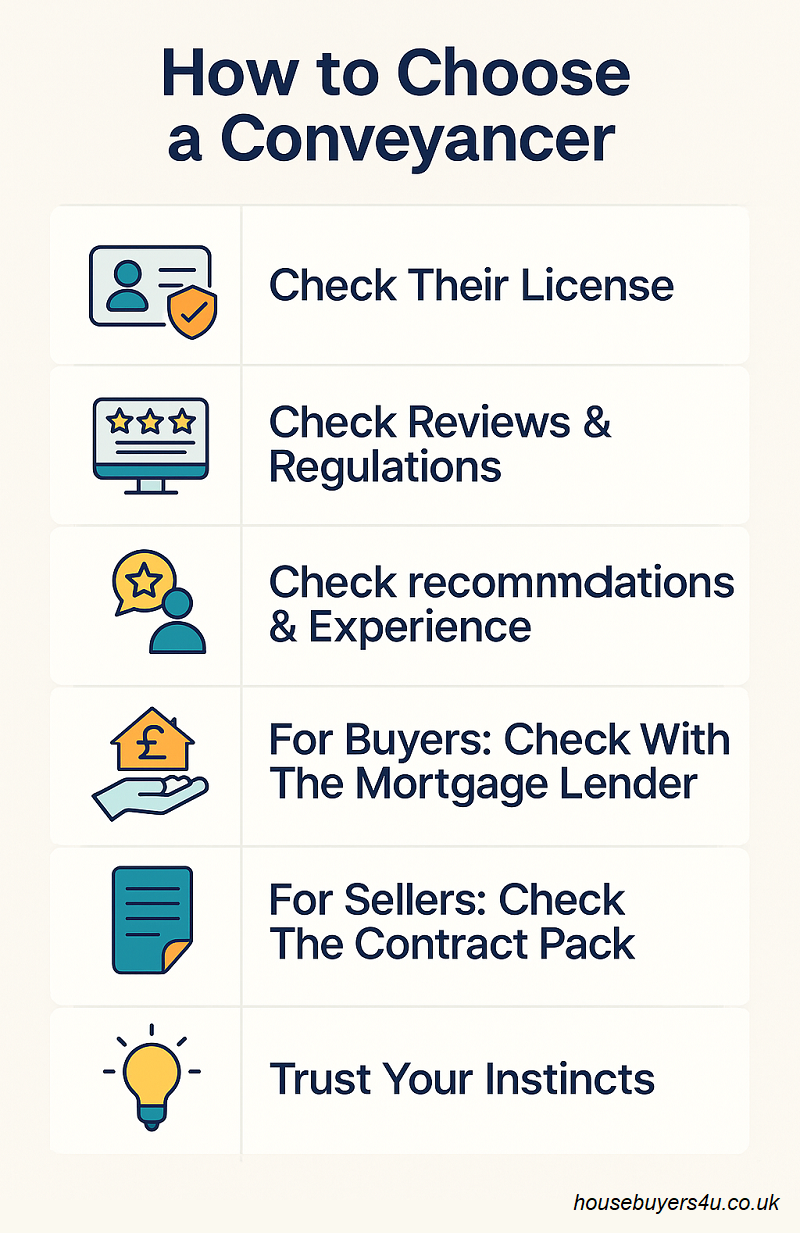

How to Choose The Right Conveyancer?

Choosing the right conveyancer is crucial, especially given that conveyancing fraud in the UK has increased by 29%. To help you make an informed decision, consider these six key factors:

1) Check Their License

Before engaging a conveyancer, always verify their license. This step is critical for both buyers and sellers.

- A Lloyds Bank study found that conveyancing fraud victims lost an average of £47,000, with 45% of victims aged 39 or under.

- In 2023, buyers and sellers lost a staggering £1.7 billion due to dealings with fraudulent individuals.

To verify a conveyancer's license:

- Visit the UK Lawyers website: Search by name or organisation and location.

- Check the Council of Licensed Conveyancers (CLC) website for firm information.

- Consult the Solicitors Regulation Authority, which oversees all UK solicitors and legal services.

2) Check Reviews and Regulations

A conveyancer's reputation is crucial. Look for:

- Positive reviews from previous clients

- Affiliation with reputable property specialists

- Oversight by recognised regulatory bodies such as:

- National Association of Property Buyers

- Property Ombudsman

- Trading Standards

3) Check Recommendations and Experience

- Look beyond simple reviews to the conveyancer's years of experience.

- Consider established firms with a proven track record in UK property transactions.

4) For Buyers: Check With The Mortgage Lender

If you're applying for a mortgage:

- Verify that your chosen conveyancer is on the mortgage lender's panel.

- Be prepared to pay extra bank representation fees (potentially £200+) if your conveyancer isn't on the panel.

5) For Sellers: Check the Contract Pack

Ensure your conveyancer can effectively manage the contract pack, which includes:

- Draft Sale Contract

- Title of the Property

- Seller's property information form

A competent conveyancer should handle this paperwork efficiently, saving you time and stress.

6) Trust Your Instincts

After considering all the above factors:

- Choose a conveyancer whose communication style and energy align with yours.

- Prioritise professionals who demonstrate organisation and attentiveness.

- Remember, a good working relationship is crucial for a smooth property transaction.

How Much Should You Pay?

Expect to pay between £800 and £1,500 for standard conveyancing in the UK; however, costs can increase for more complex cases. The cheapest quote isn’t always the best some firms add extra charges for things like bank transfers, ID checks, or leasehold properties.

What’s included?

Always ask for a full breakdown that covers legal fees, searches, stamp duty, administration, and all possible extras. If a quote looks low, double-check for hidden costs.

Comparing quotes? Look for:

-

Transparent, itemised fees

-

Clear terms on what’s included (and what’s not)

-

Experience with your property type

-

Upfront information on timelines and communication

Don’t just pick based on price choose a conveyancer who’s open about costs and service.

Timeline & Red Flags

Most property transactions take 2–3 months from offer to completion, though some can be quicker or slower.

Red flags to watch for:

-

Unclear or vague fee structures

-

Slow replies or poor communication

-

Reluctance to share licence or regulatory details

-

Pressure to use their in-house services without explanation

How to spot and avoid conveyancing fraud:

-

Always verify your conveyancer’s credentials through the SRA or CLC websites.

-

Never send money to new account details without double-checking by phone.

-

Be cautious of firms with no physical address or professional insurance.

Related Read: How to Check if a Company is Reliable

If anything feels off, trust your instincts and don’t be afraid to walk away.

Need Help Finding the Right Conveyancer?

If you’re feeling unsure or want a second opinion before choosing a conveyancer, Housebuyers4u is here to help.

Our team can answer your questions, point you towards trusted professionals, or guide you through your next steps, with no pressure and no obligation. Contact us today for honest, friendly advice that puts your interests first.