What are House Deeds & What do they Look Like? (UK Explained)

Updated: March 2025

House deeds are legal documents that prove property ownership, containing key details like ownership history, boundaries, and mortgage information. While older properties may still have physical paper deeds, most modern homes are digitally registered with the Land Registry, ensuring secure, legally recognised proof of ownership. Understanding house deeds is essential when buying, selling, or updating property records in the UK.

Key Takeaways

- House deeds confirm legal ownership and include essential property details.

- Most properties are digitally registered with the Land Registry, replacing the need for paper deeds.

- You can access your house deeds online or request copies if needed for legal or financial purposes.

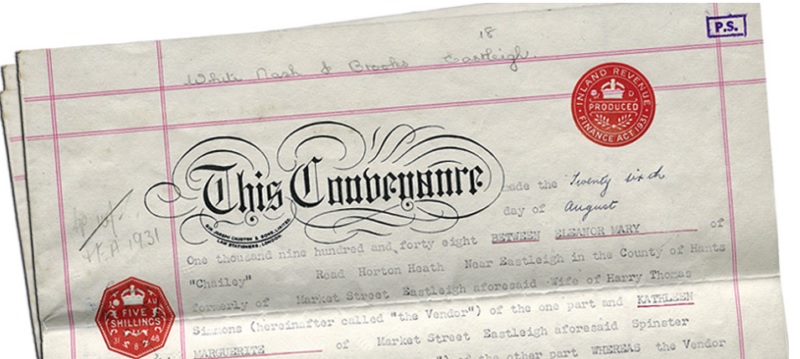

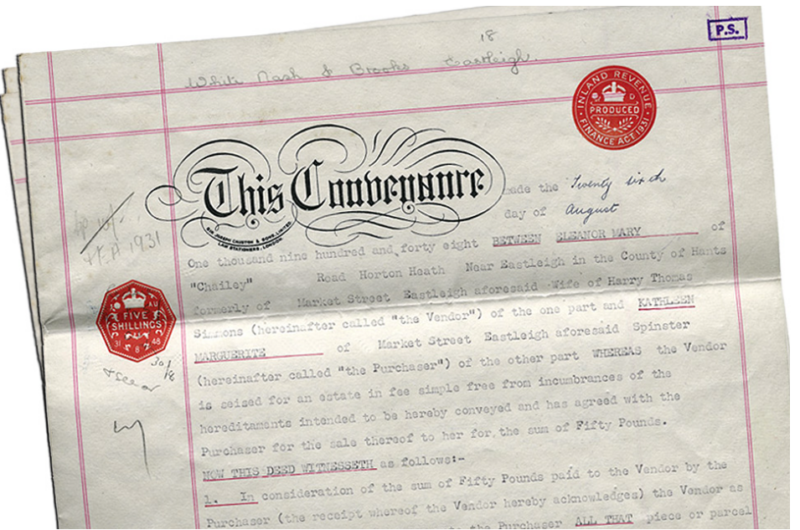

What Do House Deeds Look Like?

This is a photo of a real house deed document

The appearance of house deeds depends on when the property was purchased and whether it has been registered with the Land Registry. Older properties may still have physical paper deeds, while most modern homes have digital title records stored securely online.

Physical House Deeds (Older Properties)

If your property was purchased before digital registration became standard, you may have paper title deeds. These are often bundles of documents that include:

- Names of past and current owners

- Detailed property descriptions and boundaries

- Mortgage agreements, leases, or historic contracts

Paper deeds can be handwritten, typed, or even on parchment paper for very old properties. They may also include stamps, seals, and signatures to verify legal transactions.

Digital House Deeds (Modern Properties)

Most properties in the UK are now registered with the Land Registry, meaning house deeds exist as secure digital records instead of paper documents. These records contain the same essential information as physical deeds, such as:

- Proof of ownership

- Legal rights or restrictions on the property

- Boundaries and mortgage details

Do You Need Physical Deeds?

For most homeowners, physical deeds are no longer necessary. The Land Registry’s digital records are legally valid proof of ownership, so even if your original paper deeds are lost, the registered title provides full security. However, if your property has never been registered, physical deeds may still be required to prove ownership.

Where are my House Deeds Kept?

When you need proof of property ownership, knowing where your house deeds are is key! Here's the breakdown of where to look and who holds the deeds to your house in the UK:

-

The Land Registry: Your First Stop Start with the Land Registry. They maintain secure digital records of most property ownership in England and Wales, including title deeds. You can easily access these online.

-

Your Solicitor or Conveyancer: For Older Properties If your home is older and you used a solicitor or conveyancer during the purchase, they might have the original physical deeds. A quick call can give you the answer.

-

Your Mortgage Lender: Check for Security When you have a mortgage, your lender might hold physical copies of your deeds as security. Contact them to confirm.

Important Tip: Even with physical deeds, double-check if they've been digitally registered with the Land Registry. This gives you the most updated and secure proof of ownership.

Related read: Everything you need to know about conveyancing

Expert advice from our property expert Paul Gibbens

"One of the biggest misconceptions we see is homeowners thinking they need original house deeds to sell their property. In reality, most properties are already registered with the Land Registry, meaning the digital title record is all you need.

From our experience, the real issues arise when a property isn’t registered or has outdated ownership details—this can delay a sale by weeks or even months. That’s why we always advise homeowners to check their title status early, especially if they plan to sell. If there are missing deeds or ownership complications, sorting them out in advance can save you time, stress, and unnecessary legal costs."

How to Get a Copy of Your Property Deeds in the UK

Ready to get your hands on your house deeds? Here's a step-by-step guide on how to do it:

1. Start with the Land Registry

The easiest way to get official copies of your deeds is through the Land Registry website.

- Find your property's title number (your solicitor or old paperwork might have this).

- Create an account on the Land Registry website.

- Search for your property and request copies of the official deeds. There is a small fee for this service.

2. Check with Your Conveyancer

If you used a solicitor or conveyancer when buying your home, they might have a copy of your deeds, especially if they're older. Give them a call!

3. Contact Your Mortgage Lender

If you have a mortgage, your lender might hold your physical deeds as security. Reach out to them to find out if they have them and how to retrieve a copy.

Related: How to get a mortgage in 2024

How to Update or Change House Deeds

Life happens, and sometimes those changes affect the ownership of your property. Here's what to know about updating your house deeds in the UK:

When Do You Need to Update Deeds?

- Death of an Owner: Updating the deeds becomes part of the probate process.

- Gifting Property (or Part of It): The Land Registry needs to record the transfer of ownership.

- Divorce or Separation: If you jointly own property, any changes to ownership need to be reflected in the deeds.

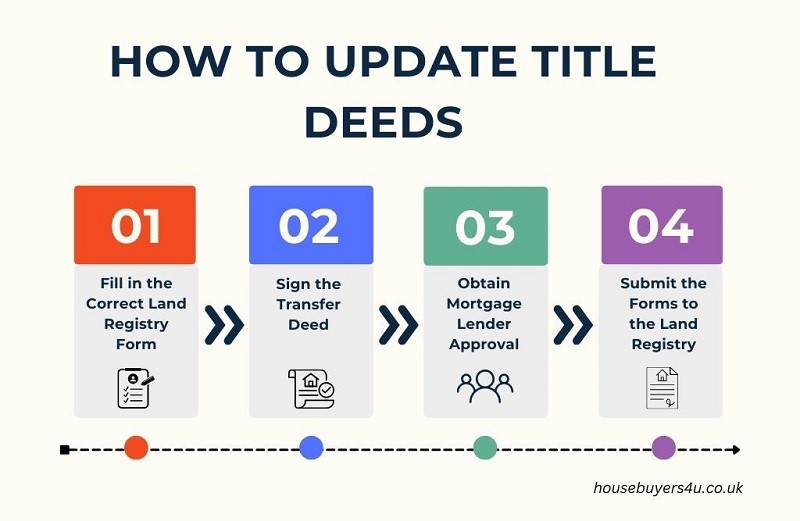

How to Update Title Deeds (Step by Step)

-

Fill in the Correct Land Registry Form

- AP1 Form – If updating details on a registered property (e.g., changing ownership due to inheritance or divorce).

- TR1 Form – If transferring full ownership to someone else.

- TP1 Form – If transferring part of the property (e.g., gifting a share).

- ID1 Form – Required for identity verification if you’re not using a solicitor.

-

Sign the Transfer Deed

- All involved parties (current and new owners) must sign the TR1 or TP1 form before submitting it.

-

Obtain Mortgage Lender Approval (If Applicable)

- If there’s a mortgage on the property, you’ll need the lender’s written consent before making ownership changes.

-

Submit the Forms to the Land Registry

- Send the completed forms along with:

- Any required supporting documents (e.g., probate documents, divorce settlement paperwork).

- The applicable Land Registry fee (varies based on property value).

- Send the completed forms along with:

Additional Notes:

-

- If updating contact details or correcting minor errors, you may only need a COV (Change of Name or Address) form instead of an ownership transfer.

- If the update is due to death, you’ll also need a death certificate and probate documents.

Can I Remove a Name from the Property Deeds?

Yes, you can remove a name from property deeds if ownership changes due to divorce, separation, inheritance, or other legal reasons. This process involves submitting a TR1 or TP1 form to the Land Registry, along with an AP1 form if the property is registered. If there’s a mortgage, you’ll also need lender approval before removing a name. It’s recommended to seek legal advice to ensure the transfer is processed correctly and does not affect your financial or legal standing.

How We Helped a Homeowner Going Through Divorce Sell Fast & Change Title Deeds

We recently assisted a client whose divorce settlement involved updating their house deeds. The Land Registry process was straightforward, but ensuring correct legal wording on the transfer documents was crucial for protecting everyone's interests.

You can read the full story here: Birmingham Divorce Resolution

What Happens if I Lose Title Deeds?

Losing your house deeds may seem like a major issue, but in most cases, it’s easily resolved. If your property is registered with the Land Registry, you don’t need the original deeds—your ownership is already securely recorded. However, if your property isn’t registered, you’ll need to take steps to prove ownership.

How to Recover Lost Title Deeds

- Check the Land Registry: Search for your property on the Land Registry website (£3-£7 fee). If it’s registered, your ownership details are already recorded, and you can request official copies.

- Prove Ownership if Unregistered: If your property isn’t registered, you may need old mortgage documents, conveyancing records, or a solicitor’s statement to prove ownership.

- Apply for Possessory Title: If no official deeds exist, you can apply for Possessory Title, which acts as proof of ownership. After 12 years without dispute, this can be upgraded to Absolute Title.

- Consider Indemnity Insurance: If there’s uncertainty over ownership, indemnity insurance can provide financial protection against future claims.

If you’re unsure, a solicitor or conveyancer can guide you through the process to ensure your property rights are fully protected.

Need to Sell a Property Without the Hassle of House Deeds?

If you're dealing with lost house deeds, ownership complications, or delays in updating title records, selling your property can feel overwhelming. At Housebuyers4u, we specialise in buying properties quickly and hassle-free, even if you’re missing key documents or need to transfer ownership fast.

- Sell in as little as 7 days – No delays, no uncertainty.

- We handle the legal process – No need to worry about missing paperwork.

- Guaranteed sale, no agent fees – A stress-free way to move forward.

Sell Your House Fast with Housebuyers4u today—get a free, no-obligation cash offer and let us take care of the details so you can sell your home without the hassle.