What is Capitals Gains Tax? Does your Situation Qualify?

Key Takeaways:

- CGT applies to profits on property, shares, and high-value assets but not your main home.

- Exemptions like Private Residence Relief and tax-free allowances can reduce CGT.

- If you sell property, CGT must be reported and paid within 60 days to avoid penalties

-

- What Is Capital Gains Tax?

- Who Pays Capital Gains Tax?

- How Much Capital Gains Tax Will I Pay?

- What Is the Capital Gains Tax Allowance?

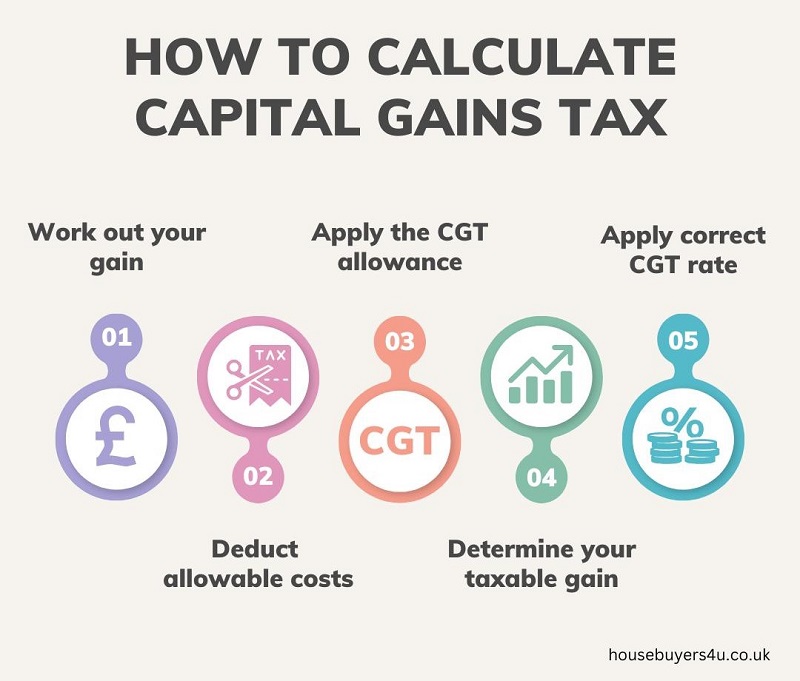

- How to Calculate Capital Gains Tax Step by Step?

- Do You Pay Capital Gains Tax on Property?

- Is There Capital Gains Tax on Inherited Property?

- How to Reduce Capital Gains Tax on Property?

- Reporting and Paying Your Capital Gains Tax

- How Housebuyers4u Can Help You Sell a Property Without CGT Hassles

- Frequently Asked Questions

What Is Capital Gains Tax

Capital Gains Tax (CGT) is a tax on the profit made when selling an asset that has increased in value, such as property, shares, or valuable possessions. Only the gain is taxed, not the total sale price. The amount you pay depends on your income tax bracket and the type of asset sold. Some exemptions apply, such as Private Residence Relief for main homes, and there are ways to reduce CGT through allowances, deductions, and tax planning.

Who Pays Capital Gains Tax?

Capital Gains Tax (CGT) applies to people and certain entities when selling or disposing of assets that have increased in value. Here’s who may need to pay:

- Individuals: If you sell a second home, investment property, shares (outside an ISA), or other chargeable assets worth more than £6,000, you may owe CGT if your gain exceeds the annual tax-free allowance.

- Trustees & Personal Representatives: If you manage a trust or handle the estate of someone who has passed away, CGT may apply when assets are sold, particularly if their value has increased since inheritance.

- Self-Employed & Business Partners: If you sell business assets, including property, goodwill, or shares in a partnership, you may need to pay CGT. Business Asset Disposal Relief (BADR) may reduce the tax rate to 10%.

- Limited Companies: Companies do not pay CGT. Instead, they pay Corporation Tax on any profits from selling assets, currently at 19% (or 25% for higher profits).

Some exemptions apply, such as Private Residence Relief for main homes and certain investments within ISAs or pensions. Understanding CGT liability early can help you plan and reduce tax where possible.

How Much Capital Gains Tax Will I Pay?

The amount of CGT you pay depends on your taxable income and the type of asset you’re selling.

Capital Gains Tax Rates (2024/25)

| Asset Type | Basic Rate Taxpayer | Higher/Additional Rate Taxpayer |

|---|---|---|

| Property (not main residence) | 18% | 24% |

| Other assets (shares, valuables, business assets) | 10% | 20% |

Example Calculation for CGT

If your taxable income is £35,000 and you make a capital gain of £10,000:

- Any part of your gain that keeps you within the basic tax band (£37,700 threshold) is taxed at 10% (or 18% for property).

- The portion that exceeds this threshold is taxed at 20% (or 24% for property).

We’ve helped many sellers understand how CGT rates impact their final sale profits. One common mistake we see is homeowners assuming all gains are taxed at the same rate, leading to unexpected bills. Understanding how income tax bands affect CGT rates can make a significant difference.

Our advice? Work out your total taxable income before selling—this can help you estimate your CGT liability and take advantage of lower tax bands where possible.

Related Read: How much is my house worth?

Do You Pay Capital Gains Tax on Property?

Yes, you will need to pay Capital Gains Tax (CGT) when selling a buy-to-let, second home, or inherited property if it has increased in value. Your main residence is usually exempt, but CGT may still apply if you rented it out, used part of it for business, or if the total land size (including gardens and outbuildings) exceeds 5,000 square metres. The amount you pay depends on your taxable gain after deducting allowable costs and applying the £3,000 CGT allowance for 2024/25.

Our advice? Consult a tax expert early to explore relief options and avoid surprises. If you need a fast, hassle-free sale, a cash buyer offers certainty while helping you manage tax obligations efficiently.

Is There Capital Gains Tax on Inherited Property?

You don’t pay Capital Gains Tax when you inherit a property, but if you sell it later for more than its inherited value, CGT may apply. The taxable gain is the difference between the property's market value at the time of inheritance and the sale price. You can reduce CGT by deducting selling costs and any qualifying expenses related to property improvements.

Example of CGT for an Inherited Property

If you inherit a property valued at £250,000 and later sell it for £300,000, the taxable gain is £50,000. After deducting your £3,000 CGT allowance, the remaining £47,000 is subject to tax at either 18% or 24%, depending on your income.

How to Reduce Capital Gains Tax on Property

There are several ways to legally reduce your Capital Gains Tax liability when selling a property.

- Private Residence Relief: If the property was your main home at any point, you may qualify for full or partial relief, reducing the taxable gain.

- Lettings Relief: If you previously lived in the property but later rented it out, you could claim relief on a portion of the gain.

- Offset Losses: If you have made losses from other asset sales in the same or previous years, these can be used to reduce your taxable gain.

- Transfer to a Spouse: There is no CGT on transfers between spouses or civil partners, which can be used for tax planning.

- Use CGT Allowance: Selling assets gradually over multiple tax years allows you to take advantage of the annual CGT exemption (£3,000 per person for 2024/25).

Proper tax planning and professional advice can help minimise CGT liabilities when selling a property.

Expert insight from our property expert Paul

"From my experience, many homeowners unknowingly overpay Capital Gains Tax simply because they aren’t aware of the reliefs available. Private Residence Relief and Lettings Relief can significantly reduce your tax bill if you’ve lived in the property at any point.

I always recommend planning ahead—if you’re considering selling an investment property, spreading the sale across tax years or transferring assets to a spouse can make a big difference. Strategic planning is key to minimising CGT while staying compliant."

Reporting and Paying Your Capital Gains Tax

Capital Gains Tax must be reported and paid within specific deadlines, depending on the type of asset sold:

- Property Sales: If you sell a property subject to CGT, you must report and pay the tax within 60 days of completion. Failure to do so may result in penalties and interest.

- Other Assets (Shares, Investments, Valuables): Declare any capital gains in your Self-Assessment tax return by 31 January following the end of the tax year in which the sale occurred.

- How to Pay: The easiest way to pay CGT is through the HMRC online portal, where you can report your gain and make direct payments.

How Housebuyers4u Can Help You Sell a Property Without CGT Hassles

Selling a property quickly can help you manage tax liabilities effectively, especially when facing Capital Gains Tax deadlines. At Housebuyers4u, we offer a guaranteed cash sale with:

- Completion in as little as 7 days: Avoid delays that could impact your tax obligations.

- No estate agent or legal fees: Keep more of your proceeds without additional costs.

- Hassle-free process: No mortgage complications, no chain risks, and a straightforward sale.

If you're looking for a fast, secure sale to avoid CGT complications, get a free, no-obligation cash offer today.