Can My Son Buy My Council House for Me? Right to Buy Rules Explained

Yes, your son can help you buy your council house, but typically, you (the tenant) must also be listed as a buyer due to Right to Buy scheme rules. Family members often support council tenants financially or through joint purchases, but strict eligibility criteria apply.

Key Takeaways:

- Your son usually can’t buy your council home independently unless he’s also a secure tenant.

- Joint applications or financial assistance from family members are common and permitted.

- Proper legal structuring is vital to avoid repayment penalties or scheme breaches.

-

- Can My Son Buy My Council House Directly?

- How Your Son Can Help Buy Your Council House

- Can Other Family Members Buy My Council House?

- Important Legal Considerations You Must Know

- Can I Add My Son to My Council Tenancy?

- A Final Word: Is It the Right Move for You and Your Family?

- Frequently Asked Questions

Can My Son Buy My Council House Directly?

In most cases, your son cannot buy your council house on his own through the Right to Buy scheme. This is because only the tenant(s) with a secure or assured tenancy are eligible to purchase the property under the scheme. If your son is not listed as a tenant on the council tenancy agreement, he cannot apply for Right to Buy independently.

Who Can Be Named on a Right to Buy Application?

- You (the secure tenant) must be the primary applicant.

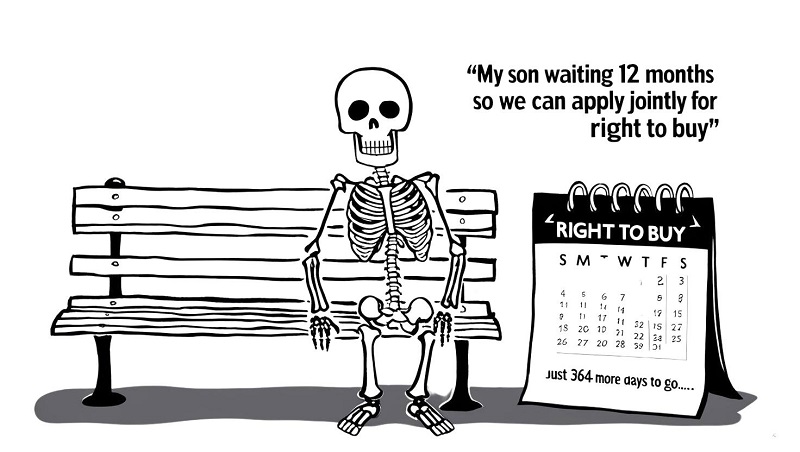

- Up to three family members can apply with you, but only if they’ve lived in the property as their main home for at least 12 months before applying.

- Even if your son is helping financially or plans to live with you later, he must meet the 12-month residency rule to be included.

Important: Family members not named on the tenancy agreement or without 12 months’ proof of residence won’t be eligible to apply or be added to the deed.

Can My Son Buy the House Without Me?

This is only possible in rare circumstances, such as:

- Your son is already listed as a joint tenant on your tenancy agreement.

- He has lived in the property long-term and meets all eligibility requirements.

- You agree to assign or transfer the tenancy to him (which councils may or may not approve), making him the legal tenant before applying.

But even then, he would need to be the legal tenant for a minimum of 3 years before qualifying for Right to Buy in his own name.

How Your Son Can Help Buy Your Council House

While your son or daughter may not be able to buy your council house outright unless they're also a tenant, they can still support you financially in several ways. This kind of help is common under the Right to Buy scheme and can make the process of purchasing your home much more achievable.

Below are some common ways family members can help, explained in a little more detail:

1) Gifted Deposits

Your son or daughter can gift you money to put towards solicitor fees, mortgage application costs, or other upfront expenses. In many Right to Buy cases, no deposit is required because the discount itself acts as equity—but a gifted deposit can help if one is needed.

This is perfectly legal and won’t affect your eligibility, as long as there’s no expectation of repayment.

Related Read: How much do I need for a house deposit

2) Joint Mortgages (Tenant + Family Member)

Some lenders allow you to take out a joint mortgage with a family member, such as your son or daughter. In this case:

- You (the tenant) must still be the main applicant on the Right to Buy form.

- Your family member can be named on the mortgage and property deeds, provided they meet the lender’s criteria and can prove affordability.

This can help if your income alone wouldn’t cover the loan.Keep in mind that this creates joint legal ownership, so all parties are financially and legally responsible for the mortgage.

3) Co-Ownership Arrangements

In some cases, families set up a co-ownership agreement to protect everyone’s interests. This typically involves:

- Clearly stating who owns what share of the property.

- Agreeing what happens if the home is sold or if someone wants to exit the arrangement.

You’ll need a solicitor to draft a formal agreement, and everyone involved should get independent legal advice.

How to choose the right conveyancer

Expert advice from our property expert Paul Gibbens:

"The best advice i can give you on this is remember - If your son provides the deposit and you remain the named tenant, this satisfies Right to Buy rules as long as all legal criteria are met. You would still need to lead the purchase, but your son’s financial support can make the process smoother and more affordable.”

Can Other Family Members Buy My Council House?

It’s a common question—can your daughter, parent, or another relative buy your council house on your behalf? The answer usually comes down to tenancy status and eligibility under the Right to Buy scheme. Here’s how the rules apply to different family relationships:

Can My Daughter Buy My Council House?

Your daughter cannot buy your council house on her own unless she is also a joint tenant or has lived with you for at least 12 months and applies jointly with you.

That said, she can help you buy it by:

- Gifting you money towards legal or purchase costs

- Taking out a joint mortgage with you

- Being added as a co-owner during the purchase process, subject to lender approval

Right to Buy must still be applied for by you, the tenant, with your daughter joining the purchase if she meets residency or financial support criteria.

Can I Buy My Mum’s Council House?

Yes, but not on your own. Your mum must remain part of the application as the secure tenant. You can:

- Support her financially

- Join the application if you’ve lived in the property with her for at least 12 months

- Be named on the mortgage and deeds (subject to legal setup and council approval)

You can’t apply for Right to Buy without your mum being involved unless you are also a secure tenant.

Can I Buy My Parents’ Council House?

Similar to the above: you can’t buy it independently unless you're also a tenant. However, you can help them:

- Arrange a mortgage in both names

- Provide financial assistance or a gifted deposit

- Be added as a joint owner if residency conditions are met

The purchase still needs to be led by the parent(s) as the eligible tenant(s).

Can a Family Member Buy My Council House?

A family member cannot buy your council house outright unless they are also a legal tenant. However, they can:

- Be added to the application if they meet the 12-month residency rule

- Help you with mortgage affordability or deposit costs

- Become a co-owner if structured legally

Right to Buy focuses on tenant eligibility, but financial help from family is common and often essential to make the purchase work.

Important Legal Considerations You Must Know

If you sell your council house within five years, you may have to repay some or all of the discount. Selling within ten years means offering it back to your former landlord first, at market value. These rules help prevent quick resales and protect social housing.

If your son or daughter is helping with the purchase, the application must still be made in your name as the secure tenant. Poorly structured purchases can lead to rejections or future disputes. You'll also be responsible for repairs, maintenance, and any service charges once the sale is complete.

Click here for more information on costs and financial considerations on buying a council house

Can I Add My Son to My Council Tenancy?

Yes, you can request to add your son to your council tenancy, but it’s up to your landlord to approve it. Most councils will only consider it if your son has been living with you in the property for a significant period—usually at least 12 months—and it’s clearly his main home. Adding him as a joint tenant can help with future succession or Right to Buy applications, but both parties then share full responsibility for the tenancy, including rent and legal obligations. Speak to your housing officer to understand your local council’s policy.

Find out how much we can Offer for your House